Outlook for US stocks, Copper and Hong Kong markets

**This is an extract from the Market Matters Weekend Report from 24 November. Click here to get access to the full report and more

I often get asked how we see things moving for the next few weeks / months, obviously this is very often random noise, but we do generally have a view which at times MM uses with regards to tweaking our cash levels up, or down. Note the below illustration for US stocks may not be mirrored by our own ASX.

As we’ve see for the last 6-months the main action has been under the hood for Australian equities as markets regularly try and second guess bond yields – until they show their hand we feel it’s hard to imagine a meaningful move by the ASX, with the potential exception of a classic Christmas rally.

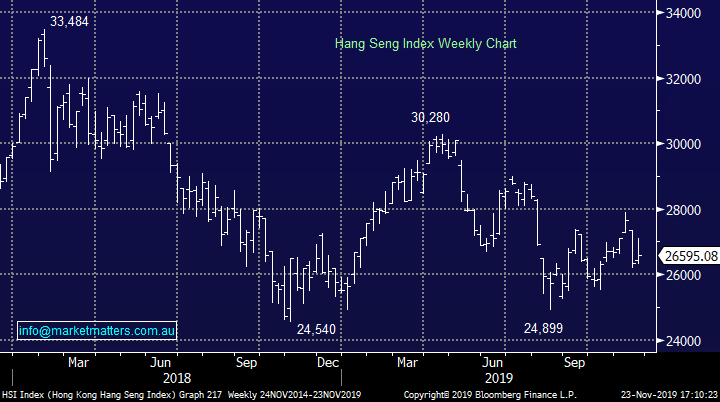

MM’s best guess moving into Christmas for US stocks is as below.

US S&P500 Index Chart

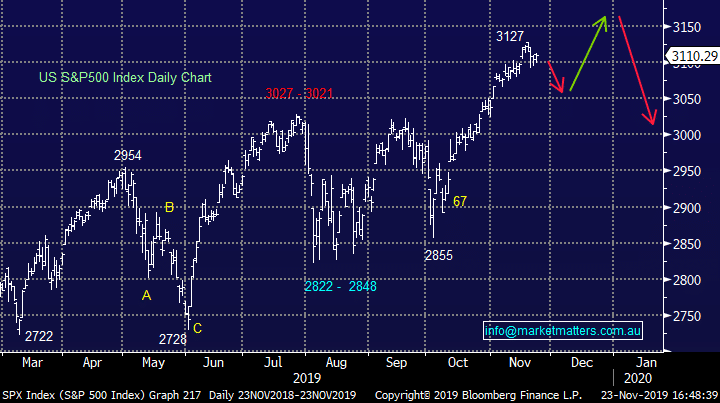

Dr Copper is one of the best indicators of global economic health and following its 25% correction we believe the risk / reward is now sitting with the buyers, especially if Trump and Xi Jinping can finally settle their dispute with regards to trade.

Technically the downtrend remains intact but the manner in which the industrial metals is holding up is encouraging.

Copper ($US/lb) Chart

Dr Copper is one of the best indicators of global economic health and following its 25% correction we believe the risk / reward is now sitting with the buyers, especially if Trump and Xi Jinping can finally settle their dispute with regards to trade.

Technically the downtrend remains intact but the manner in which the industrial metals is holding up is encouraging.

Copper ($US/lb) Chart

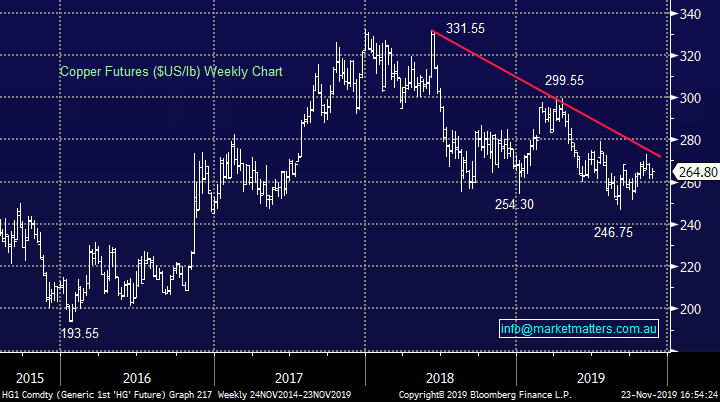

As we mentioned last week the civil unrest in Hong Kong has led to a sharp decline in both its and to a lesser extent China’s index, not surprisingly this has led to some knock on weakness in the Emerging Markets Indices – MM feels Hong Kong & China is the most likely “Black Swan” for the remainder of 2019. We like having some flexibility in our portfolios to buy potential panic selling in the region e.g. the Hang Seng around 10% lower, a drop that would probably cause a knock on effect which would satisfy our target area for bond yields.

MM would be very keen technical buyers of the Hang Seng ~24,000.

Hang Seng Index Chart

As we mentioned last week the civil unrest in Hong Kong has led to a sharp decline in both its and to a lesser extent China’s index, not surprisingly this has led to some knock on weakness in the Emerging Markets Indices – MM feels Hong Kong & China is the most likely “Black Swan” for the remainder of 2019. We like having some flexibility in our portfolios to buy potential panic selling in the region e.g. the Hang Seng around 10% lower, a drop that would probably cause a knock on effect which would satisfy our target area for bond yields.

MM would be very keen technical buyers of the Hang Seng ~24,000.

Hang Seng Index Chart