Optimism for RIO short lived following production numbers

Apologies for the late report we had technical difficulties earlier.

What Mattered Today

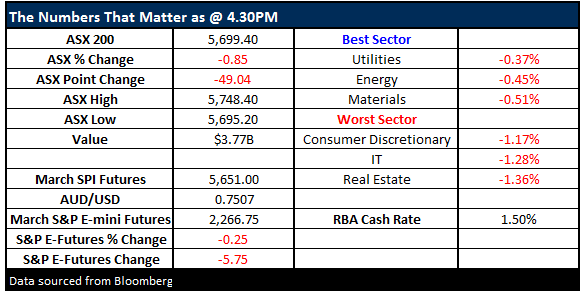

A weak session today with broad based selling pushing all sectors into the red. Initial optimism in the resource space following RIO Tinto’s Q4 production numbers was short lived and we saw a reversal into the close. We had a range of +/- 53 points, a high of 5748, a low of 5695 and a close of 5699, off -49pts or -0.85%. Volume was still low with less than $4bn going through the equity market.

ASX 200 Intra-Day Chart

ASX 200 Daily chart

In terms of production, RIO came in a tad ahead of expectations with Iron Ore from WA coming in at 87.7Mt, up 7% for the year – above the 86.8Mt expected. Others areas of the business performed strongly with the exception of Copper and Diamonds which were a slight miss. That prompted early buying and the stock traded higher during the morning session, pushing through $64.00 where we took a nice 25% profit on our short term options position – more on that below.

From around 11.15am the stock lost momentum and dropped more than $1from its highs. The issue seems to be the average price achieved on RIO’s ore for the period. Some analysts were factoring in around ~56 /t while they came in around $53.60/t. That’s worth around +$900m or about 3% of group revenue. There is little doubt that RIO will deliver a strong full year result on the 8th February when they report, but the stock has now run hard and this optimism may well be built in.For short term holders as we were in this instance, RIO and BHP gave sell signals today after trading at marginal new highs and failing.

Rio Tinto (RIO) Daily Chart

Elsewhere, some of the stocks we covered in the morning report today fell into BUY zones yet we didn’t pull the trigger – Why?

We wrote about Henderson Group (HGG) this morning, suggesting a buy around $3.75, with the stock making a low today of $3.76 before closing at $3.81. BT Investment Management (BTT) was also covered this morning as a buy below $10 with the stock trading down to $9.83 before recovering to close at $10.10. We did not buy these two stocks given the uncertainty ahead of Theresa Mays’ speech this evening which could have a large impact on the British Pound. Ideally, we would like to see the pound trade down to 1.18 v the USD , making a marginal new low which would confirm the buy trigger for HGG and potentially BTT. Just as RIO and BHP made marginal new highs today and failed delivering a short term bearish signal, watch the pound to make a marginal new low triggering a buy signal.

The market has now become tricky in the short term, and lower levels seem likely if resources crack lower. In terms of our portfolio, we simply didn’t have the desire to buy anything today and feel that keeping cash levels high (31%) will we worthwhile in the not too distant future – opportunities will present themselves but as we’ve suggested, remain open minded and flexible.

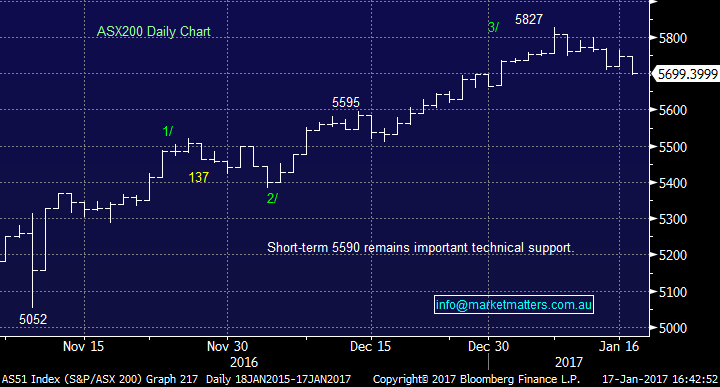

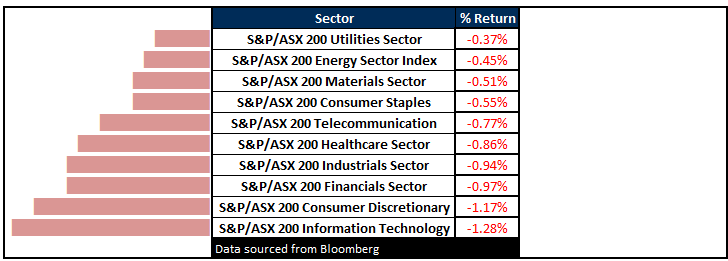

Sectors

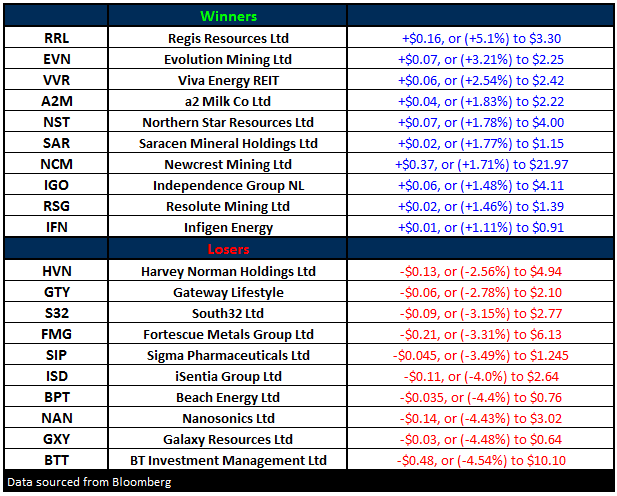

ASX 200 Movers

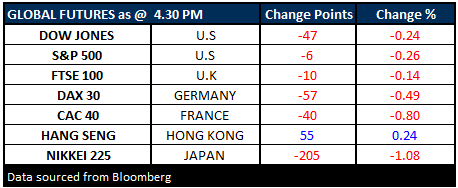

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/01/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here