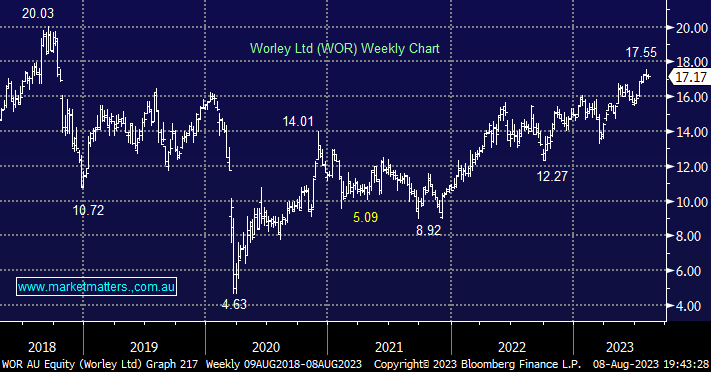

Share price gains have seen this global engineering, advisory, and project management services company grow into a $9bn business, posting fresh 5-year highs at the start of August. From a simple momentum perspective, we see no reason to doubt the stock can test $20 in 2H with obviously this month’s report likely to dictate the journey. WOR is enjoying a busy environment given the huge energy transition that is underway – they are set to be a key player in global decarbonisation. However, we are mindful that the share price is edging ahead of analysts’ expectations as we approach this month’s result:

- Analysts: 1 sell, 3 holds, 3 buys & 2 strong buys but target consensus is $16.86 below today’s price – see WOR’s detailed financials on the MM Website

Margin expansion is the key for WOR and MM went long last quarter believing the market hadn’t fully appreciated the signs from other global competitors in that sector. Historically, contractors have struggled with margins, however, their strategy day in May articulated a clear path for improvement along with the direction of the business into a greener world. In 1H23 already 39% of revenue was sustainability-related as is 73% of their factored sales pipeline.

WOR is growing revenue and expanding margins, which should in theory lead to higher earnings over time. We believe WOR is a great medium-term ESG play however the stock reacts in the short term to the looming earnings report.