WOR was one of their picks for exposure to the energy super-cycle being a major beneficiary in the development of infrastructure that will underpin our move into renewables – we all know how big a task this will be. The company’s FY22 result was strong with underlying EBITDA growth of 18% to $547mn, also they reiterated their intention to invest A$100mn over the next 3-years to support its sustainability growth agenda.

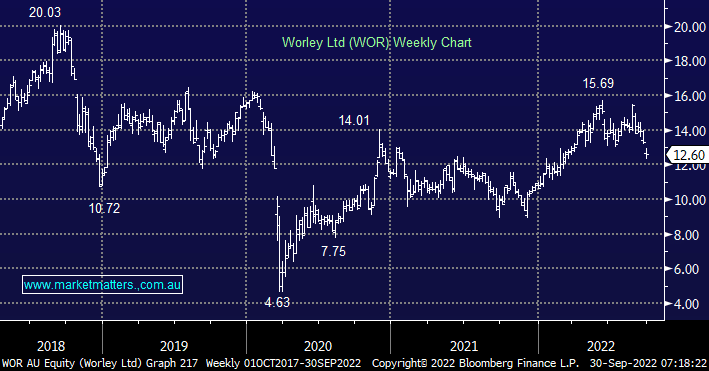

- We like WOR into current weakness with the stock offering earnings leverage to global energy and decarbonisation projects.

- The stock looks reasonable value with a P/E under 20x for 2023 compared to its average ~23x, however, it’s not screaming ‘cheap’ for the sort of business that it is (i.e. contractors rely on a lot of people and we know people are costing more and good ones are hard to find!)

Moving forward this stock could become an excellent alternative to the oil and gas producers whose profitability is more directly dependent on the underlying commodity prices.