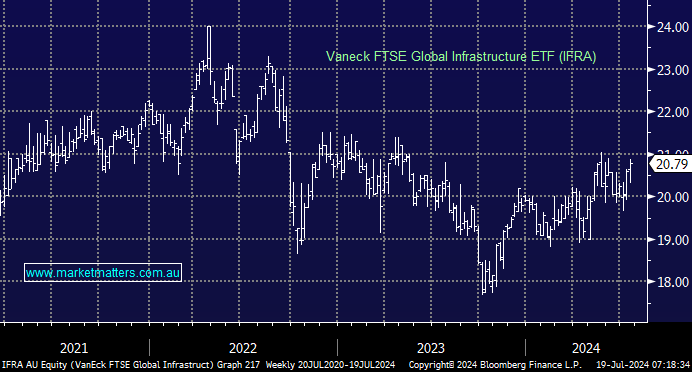

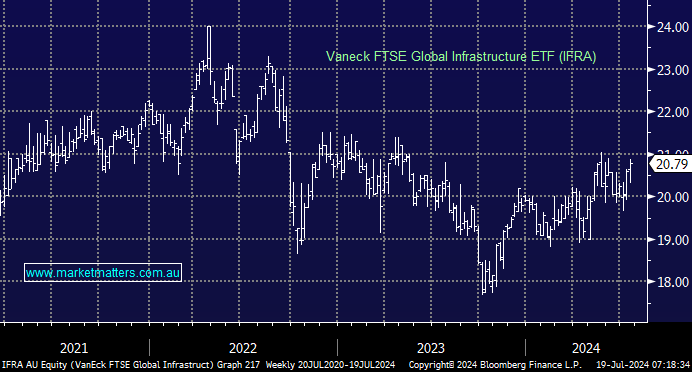

We are positioning ourselves for lower interest rates and increasing volatility across equity markets, with valuations stretching on the upside – good infrastructure stocks fit the bill perfectly. However, there are slim pickings on the local market; hence, one way to play our view is via an international ETF; we hold the IFRA ETF in our more passive ETF portfolio, which is traded on ASX. The only Australian stock in the top 10 holdings of the IFRA ETF is Transurban (TCL), with a 4.6% weighting. Due to large overseas exposure, this ETF hedges the currency, so that returns are solely around the performance of the underlying assets. The ETF has been paying a steady 3.3% yield for the yield-conscious investor over recent years.

- We are initially targeting the $22 area for this ETF – MM is long the IFRA ETF in our Core ETF Portfolio.

Local infrastructure stocks come from two distinct clusters: transportation and utilities. The underlying index has performed well even in a relatively high interest-rate environment, a move that we can see continuing when the RBA starts to ease monetary policy.

We have recently touched on a few of these companies, which we’ve summarised below. Today, we’ve focused on three stocks that haven’t been mentioned in recent months.

- Utility company APA Group (APA) is forecast to yield ~7% over the next 12-months. MM is bullish and long in our Active Income Portfolio.

- Toll road operator Transurban (TCL): we are bullish towards TCL at current levels below $13.