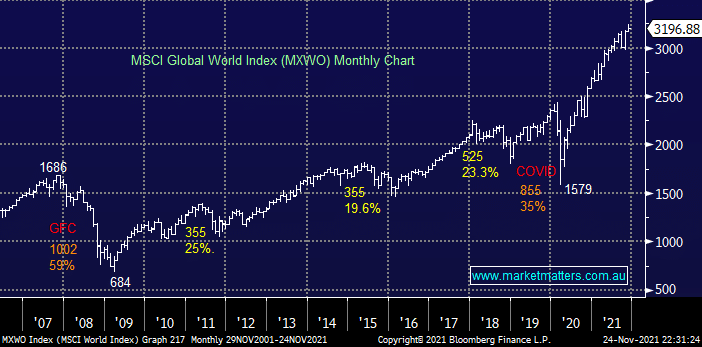

Since the GFC the trends undoubtedly been your friend with the stock market, especially with standout phenomenal gains delivered by the tech sector since COVID changed our lives in early 2020. However over the last decade, while equities were rallying, we’ve still experienced 4 corrections of basically 20% or more which suggests another adjustment is likely through 2022/23 – note another 20% wouldn’t be a dent in the markets almost vertical advance since Q1 of last year.

I was fascinated last night to hear that a friend’s 10-year son had started investing in stocks, I was especially happy to hear its was top 100 names as opposed to “speccys” or even cryptos! I also noticed that he hadn’t sold any positions yet and was only thinking in terms profits / upside, no major thought was being applied to the downside but he is 10 and I was actually really proud of him, certainly beats Tic Tok etc. After my initial admiration I had an interesting comparison pop into my mind:

- Are the millennials the new taxi drivers of the 80’s, after all we now have Uber as opposed to the story telling guys of my early days in the city.

- Millennials have roughly doubled their holdings in equities over the last year as we consistently hear of how many new accounts are being opened with the rapidly increasing number of on-line brokers.

- 45% of millennials are more interested in investing in the stock market today than they were just 5-years ago.

The saying used to be when the taxi drivers are buying / talking about a stock its time to get out, at this stage MM is currently thinking it’s more a case of being cautious and openminded as we enter 2022.