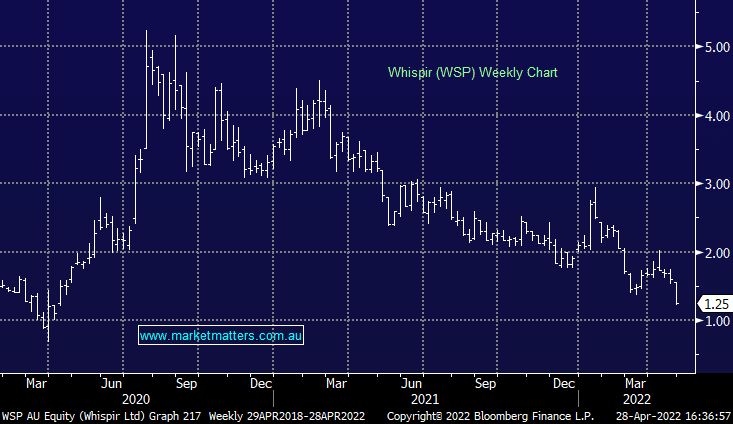

WSP -14.97%: cloud communications business Whispir was out with their 3rd quarter update yesterday with numbers largely in line with expectations. Revenue targets were pushed to the top end of guidance near $68m with Annualized Recurring Revenue (ARR) up 245% YoY to $62.4m. Costs were down as well with the headcount reduced slightly, though total cash burn was marginally higher. Numbers are trending well into their seasonally strongest final quarter so it came as a surprise to see the selling pressure on the stock today. While the performance was solid in our view, the market was aggressive on the sell-side today.

scroll

Question asked

Question asked

Question asked

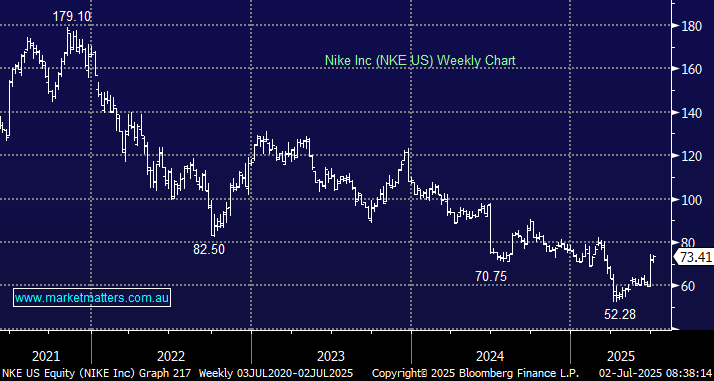

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

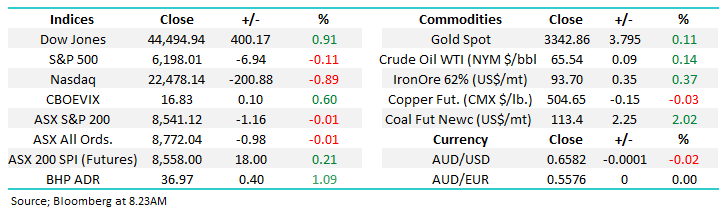

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Close

Close

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Close

Close

MM is reviewing WSP ~$1.25

Add To Hit List

Related Q&A

Update on 4 emerging company share positions

MM thoughts on WSP, AD8 & NTO

Does MM still like Whispir (WSP)?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.