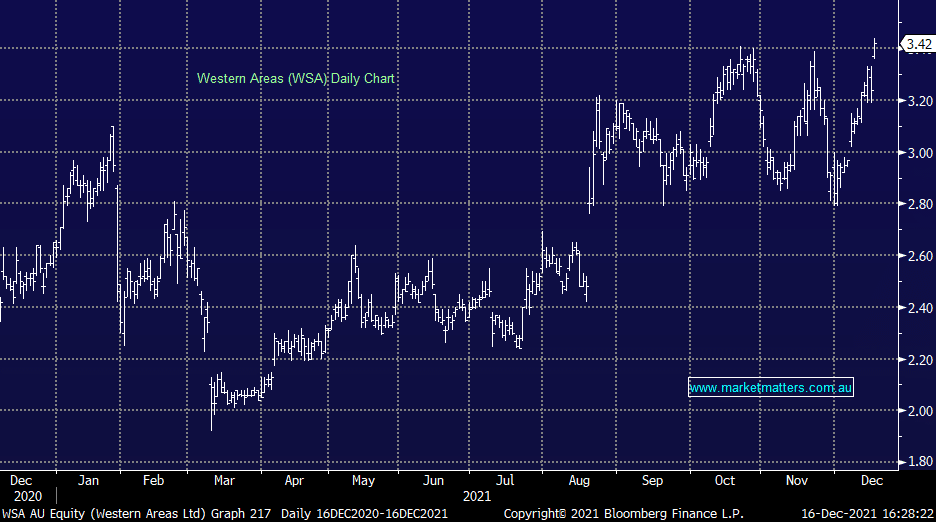

WSA +5.56%: finally received a binding takeover offer from Independence Group (IGO) after months of talks. The $3.36/sh all cash offer was a surprise given a scrip deal was touted from the outset. The price is a 35.5% premium to the close on 18 August when news first broke of the potential tie-up. It’s an on message target for Independence Group which has been looking to build out their battery metals exposure with more substantial nickel production. The deal will be funded by cash reserves and debt and is expected to be cash flow accretive by FY24. Shares traded well through the offer price today. Andrew Forrest’s investment vehicle Wyloo Metals has been creeping up the substantial shareholder ranks throughout the second half of this year, currently sitting on a little over 6%. Many suggesting he will throw his hat in the ring now that Independence Group has shown their hand.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Related Q&A

MM’s current thoughts on WSA

How to play Australia’s Nickel names

WSA, ASM & am I too late to buy Calix (CXL)?

Western Areas (WSA)

RBL & WSA questions

Views on Nickel

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.