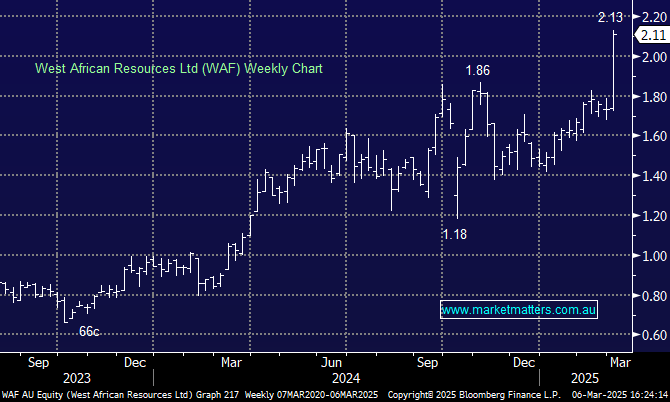

WAF +11.94%: A strong day for the Burkina Faso based gold miner as it released impressive FY24 results, the unhedged approach delivering a huge boost to profitability with the gold price continuing its rally higher.

- FY24 Profit after tax $246.2 million, +49% yoy

- FY24 Revenue $730 million, +10% yoy

- FY24 Operating cash flow $251.6 million, +21% yoy

- Cash as at 30 December 2025 sitting at $392 million

The company is currently a single-asset producer however construction of their Kiaka project is nearing completion with operational readiness in-line with budget and scheduled for first gold in Q3 2025 so are enroute to producing upward of ~420,000 oz per year. With a substantive balance sheet they’ll be able to weather unexpected capital and operating expenses there, but can also start exploring capital management in the form of a maiden dividend, or deleveraging and paying down debt.

We would caution specific jurisdictions like Burkina Faso, where we’ve seen a higher degree of political uncertainty and potential for intervention. From a purely financial and operational perspective, the company is in a very solid position.