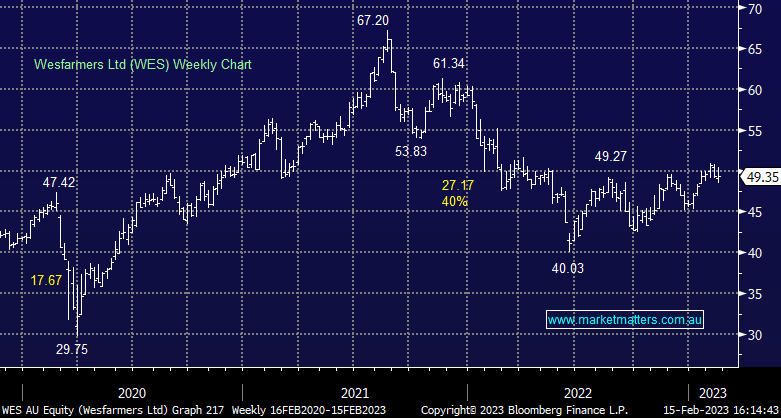

WES +1.33% : A solid result today from Wesfarmers with revenue up 27% Y/Y to $22.6bn which was above consensus of $20.5bn, driving a ~9% beat to earnings before tax (EBT) while they declared a 1H23 dividend of 88cps. The result was driven by Kmart as consumers traded down, while their Chemical, Energy & Fertilizer business was also strong. Bunnings produced $1.3bn EBT – up 1.5% and inline with expectations while Catch & Office Works were light on. They said retail trade for the 1st 5wks was broadly in-line with 1H23 growth, which is a good outcome. No guidance was provided which is customary for WES, however, the market is expecting FY23 revenue of $40.42bn and FY EBT of $3.76bn. Given they produced $2.1bn in 1H23, there is some slight deterioration already priced in by the market.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

We have turned more positive WES following this result and will hold our position in the Income Portfolio

Add To Hit List

Related Q&A

Thoughts on REA, CAR, & WES please

Thoughts on retailers PMV & WES please

Is MM bearish enough on Wesfarmers (WES)?

WOW and WES Bargains after sell off?

Are WOW and WES bargains after this sell-off?

What are MM’s best income stocks?

WES acquisition of API

Is Wesfarmers a buy?

The Major Supermarkets

Thoughts on WES, NEC & JBH

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.