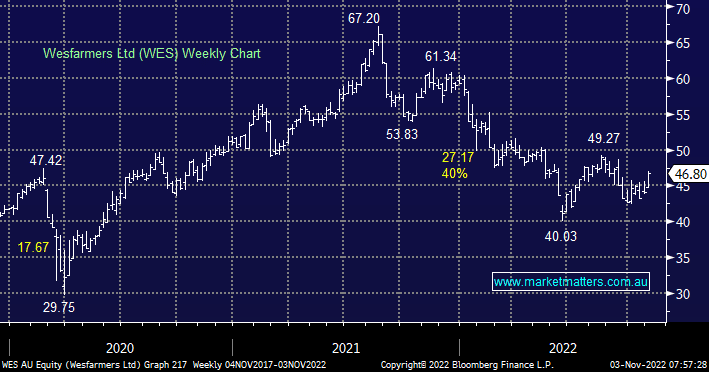

WES has endured a 40% correction since August 2021, we now believe solid value has returned to this diversified business plus an attractive yield is looming in early 2022. The company delivered better-than-expected FY22 results in August including and earnings beat of around 5%. No guidance was provided, which is customary for WES, but they did talk about positive trends playing out at the start of FY23 and we can see the stock rallying into its next result in February.

- We like WES at current levels initially targeting a move into the low $50 region.