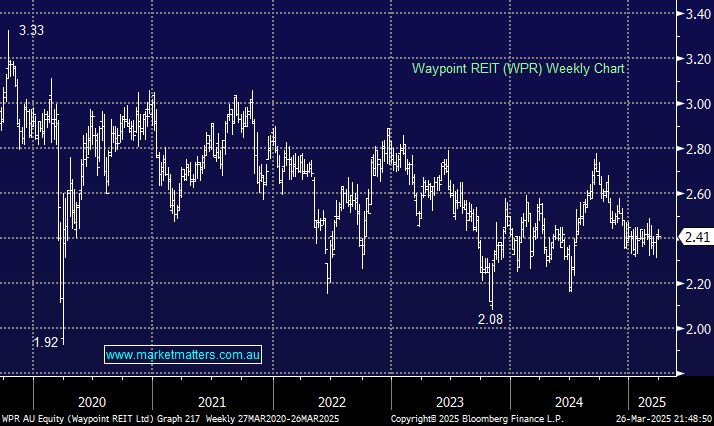

We have taken some poetic licence here due to the fascinating nature of its business model, with WPR expected to yield closer to 6.9% over the coming years. This REIT owns a portfolio of more than 400 fuel and convenience assets. Their key tenant is Viva Energy (VEA), which contributes well over 90% of the company’s rental income, although this isn’t a significant concern to us. The considerable risk lies in EV penetration and its knock-on impact on service stations. If, in the future, we all charge our EVs at home, these sites will likely become apartment blocks, at least in cities. Hence, we ultimately see the increasing demand for hybrids and EVs negatively impacting the sector.

At the end of 2024, WPR’s net tangible assets (NTA) per security stood at $2.76, while the total investment portfolio was valued at approximately $2.8 billion. Notably, over 90% of their debt was hedged as of December 31, 2024, with a weighted average hedge maturity of 2.6 years, so rate cuts will benefit WPR, but not immediately.

- While we view WPR as a solid operator, paying a high and attractive yield, the uncertainty around service station values in the years ahead has us more cautious, preferring other yield plays.