When investing for income, it’s always a trade-off between earning a high yield now or building a growing stream of income over time, as companies retain a larger portion of earnings to support future growth. At MM, we favour the concept of income growth over time. To achieve that, we need to recognise that rating stocks purely on their absolute yield today will likely have a negative impact on dividend and income growth at the portfolio level over the long term. Like any good team, we need players who bring different strengths to the mix, and we firmly believe an income portfolio should contain a blend of high-yielders today and consistent dividend growers.

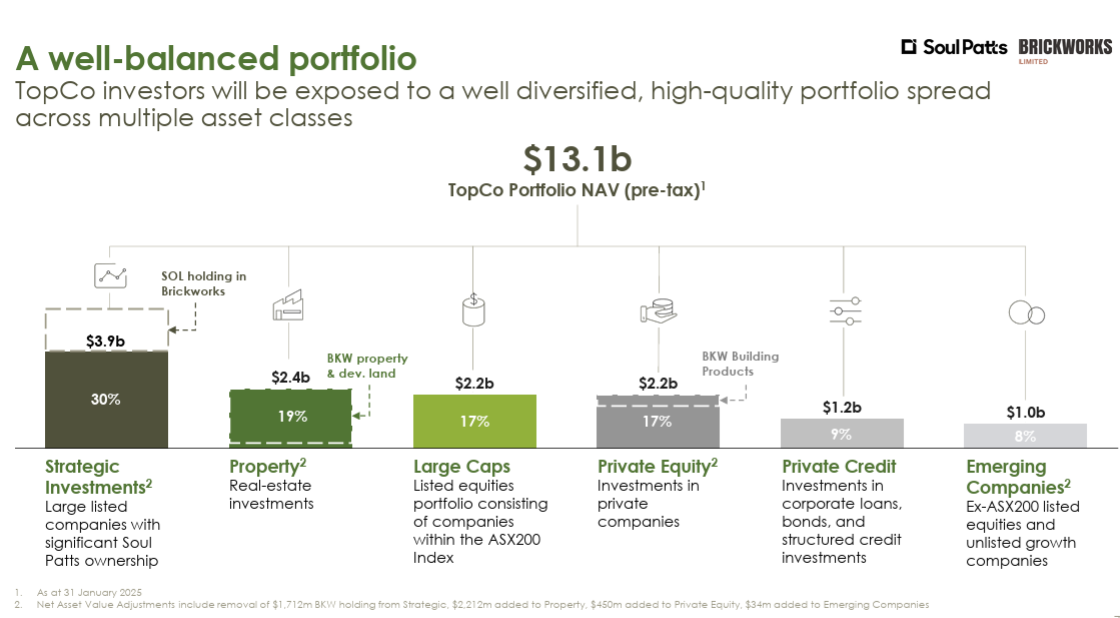

Washington H. Soul Pattinson (SOL) falls into the latter category, having never missed a dividend since listing in 1903, and increasing its payout every year for more than two decades. As a refresher, SOL has evolved from a Sydney pharmacy in the early 1900s into a multi-asset investment house with exposure across equities, private businesses, credit, and property. It’s effectively a listed conglomerate of investments.

It has recently merged with Brickworks (BKW), marking the most significant strategic shift in Soul Patts’ history. The two companies have been tied together for decades through a complex cross-shareholding structure, and the merger will unwind this to form a larger, cleaner, and more investable entity, in MM’s view.

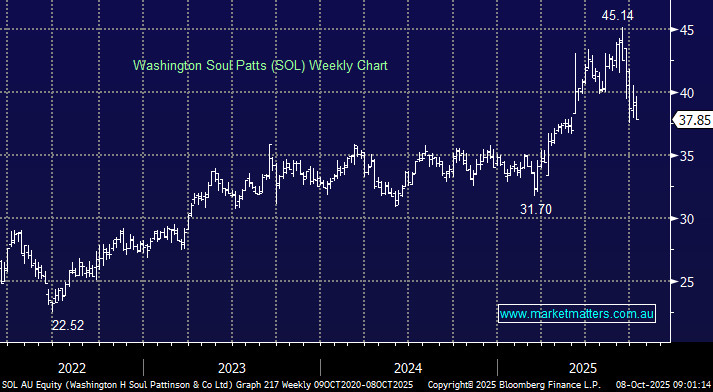

Because of this structure, SOL has traditionally traded at a discount to its asset base; however, once the merger settles, we think this could change. While the dividend yield is not overly compelling right now at 2.93% fully franked (based on consensus forecasts), we expect it will grow at an annualised rate of around 6–7%. This implies that in five years’ time, the dividend would equate to roughly 4% on today’s price — plus, of course, some expected capital growth along the way — giving it a high probability of generating ~10% annualised returns.

The share price has come off the boil in recent weeks, down ~15% from a recent high of $45. Further selling could certainly occur as BKW shareholders rotate out of the stock; however, we believe the new structure will provide greater flexibility across the portfolio, improved liquidity, and more optionality to deploy capital effectively. Given their strong long-term track record, we see scope for consistent earnings and dividend growth over time.

- We are adding SOL to the Income Portfolio Hitlist.