Wilson Asset Management is arguably the most well-known manager of Listed Investment Companies (LICs) in Australia, and WAM Leaders Limited (WLE) sits within its broader stable of externally managed LICs. Under this structure, Wilson Asset Management acts as the external investment manager via a formal management agreement, selecting and managing WLE’s portfolio on behalf of the board and shareholders. The board retains responsibility for governance, while day-to-day investment decisions are delegated to the manager.

WLE is a large ~$1.8bn LIC, focused on actively managing large-cap Australian equities using fundamental, bottom-up research to identify stocks with attractive valuations and growth potential. Fees are higher than internally managed peers such as AFIC, at ~1%, and portfolio turnover is also higher. Monthly reporting provides limited near-term performance transparency, instead highlighting since-inception returns of ~12.1% p.a. (before fees) from May 2016. Estimated portfolio returns were approximately ~2.8% in FY24 and ~5.9% in FY25, although we have not verified these.

- The 7.1% fully franked dividend yield is clearly the key attraction and the primary drawcard for many investors.

When assessing LIC dividends, it’s important to distinguish between earnings-driven payouts and smoothed dividends. Smoothed dividends are paid from current profits and retained earnings, but if portfolio earnings are insufficient and reserves are exhausted, dividends must be funded through asset sales, which ultimately erode NTA. Dividend smoothing is acceptable in moderation, but it becomes problematic when portfolio returns are weak for several years while dividends remain artificially high.

In WLE’s case, dividend smoothing has generally been supported by reasonable longer-term performance. This approach is clearly appreciated by shareholders, with Wilson-managed LICs often trading at a premium to NTA, though not across all vehicles.

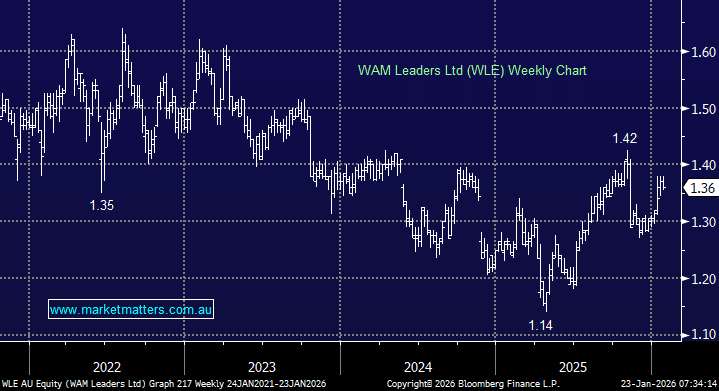

WLE is currently trading around $1.36, compared with a post-tax NTA of ~$1.325 at end-December, implying a small premium. With equity markets firmer in January, WLE is likely trading closer to NTA today. Part of this valuation support reflects the highly effective marketing engine behind Wilson Asset Management. Geoff Wilson’s advocacy for retail investors is genuine, but it is also commercially astute — and it works.

- WLE is a solid, well-managed LIC, but our preference is to buy these structures at a clear discount to NTA, not at a premium.