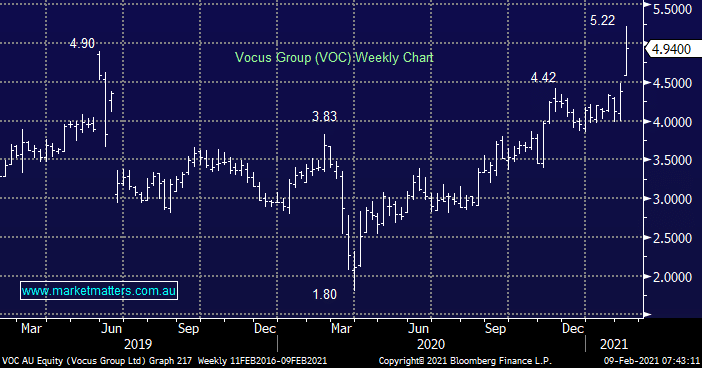

Yesterday we saw Vocus (VOC) receive its 3rd takeover offer from a consortium led by Macquarie Infrastructure, the non-binding indicative $5.50 offer values the business at $3.4bn but with the stock closing at $4.94 confidence is clearly muted that the deal will eventuate. VOC has granted due diligence but warned it’s not a guarantee any deal will proceed although we feel it might well be 3rd time lucky! If this consortium walks, there will be real concern around what is actually under the hood at this telco in turnaround phase.

When we bought VOC back in August of last year at $3.45 we sighted the inherent value of their assets as the reason for purchase. While it’s nice to see some major investors agree with us, it’s clearly frustrating that we’re not there when the main act came on stage!

While the current discount to offer price suggests the risk / reward is interesting on the upside (+10%) if again due diligence fails the downside’s likely to be 20-30% hence the simple maths says to go long today you need to be very confident with MIRA’s bid, tricky and no longer one for us.