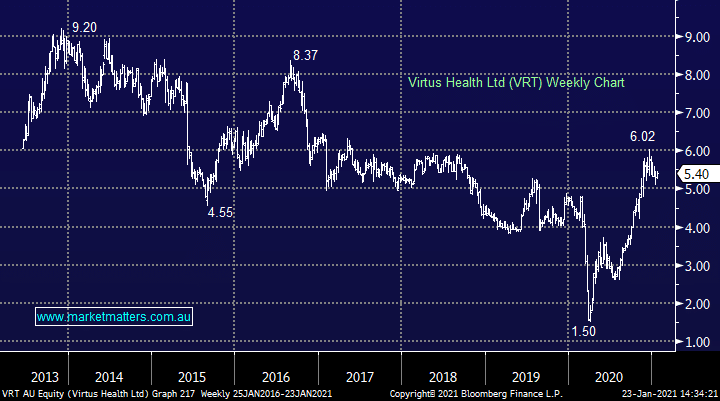

Fertility company VRT have a market cap of $434m and has rallied strongly from the COVID sell off aided by its constant 2.2% fully franked yield which was significantly higher when the stock was trading around $3. We considered this business a number of times for our Income Portfolio last year and in hindsight it would have been a solid addition but after its recent 15% pullback we see some value returning to the stock – we are bullish initially looking for ~15% upside with stops below $4.70, only ok risk / reward but the upside momentum and yield tips the scales for us.

Back in March like many stocks VRT was valued is if things would never recover, today the world is watching the early stages of a vaccine rollout and a return to elective surgery including IVF is inevitable plus VRT has the potential for international growth making is current valuation still feel conservative.