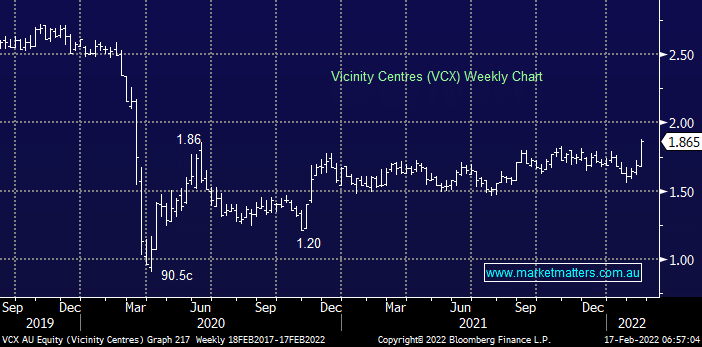

VCX soared 11% yesterday after it posted an excellent half year result which saw a net profit after tax (NPAT) of $650mn. The countries 2nd largest Australian retail property manager illustrated people are still “going to the shops” and if Chatswood in Sydney is any indication that’s 100% on the money. The companies result was even more impressive after it previously delivered a loss of $320mn and its local operations have actually managed to perform strongly even through COVID. As we suggested in yesterday afternoons ‘Match Out’ report the shopping centre landlord is signing up new tenants on decent metrics, with 91% of all new deals negotiated with fixed annual increases of at least 4% (most were more like 5%).

The companies guidance for FY2022 is strong and its estimated 3.5% yield over the next 12-months is ok for a stock appearing very capable of delivering some healthy capital gain.