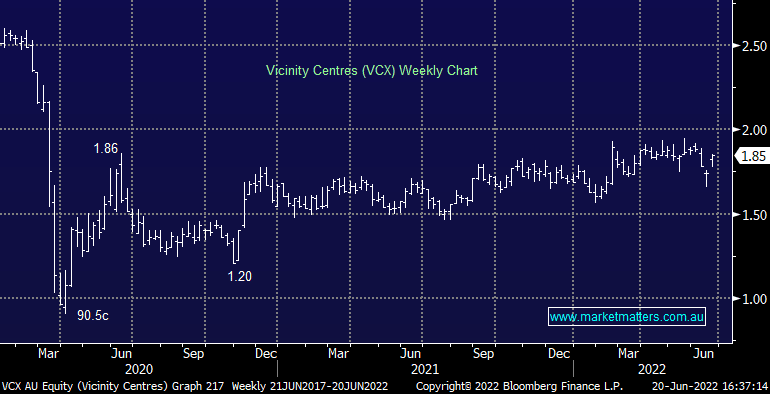

VCX +6.32%: the shopping centre owner popped today on the back of strong valuations and better guidance. The book value on their assets was increased by $245m ahead of the end of the financial year, largely on the back of tighter cap rates which fell to 5.31%, from 5.35% with 56% of their assets independently valued. Funds From Operations (FFO) guidance was also increased to at or above the top end of the previous 11.8-12.6cps guidance that was reaffirmed last month, though distribution guidance was amended to the lower end of the 95-100% range. The update said that foot traffic had continued to improve and collections had followed as a result, with rental collections up to 91%.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM sees deep value in VCX & property stocks generally

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.