Ventia is an often-ignored $3.6bn infrastructure business that enjoys a few major tailwinds as we move into 2025. 8 analysts cover VNT and all are buy rated with a consensus price target of $4.56, implying 7% upside.

- VNT enjoys ~37% of its revenue from defence spending, which looks poised to grow globally as geopolitical tensions escalate.

- Its telecommunications and transport sectors grew by over 20% in 2023*, supported by contracts like NBN’s fibre upgrades and Telstra’s intercity fibre builds. Ongoing growth opportunities exist, driven by increasing demand for high-speed internet and infrastructure upgrades.

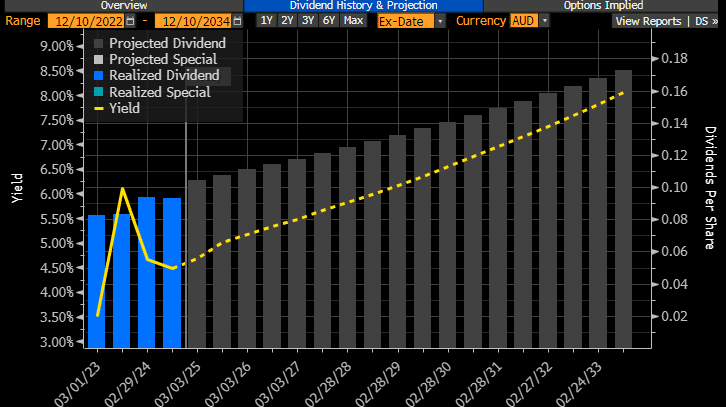

- VNT is forecast to yield 5% part-franked in the next 12-months, rising towards 7% in the next 5-years, an attractive income with the RBA set to cut rates by ~1% over the next 1-2 years.

*VNT wraps up FY24 in December, hence reference to 2023.

Ventia Services’ strong balance sheet and low gearing suggest that the Australian infrastructure services provider could return additional cash to shareholders, according to Macquarie. The investment bank expects the double-digit revenue and EBITDA growth seen in the first half to continue through the remainder of the year, supported by telecommunications, defence and social infrastructure. They see upcoming defence contract renewals as a potential opportunity, estimating that every A$100 million in annual defence revenue adds 2% to Ventia’s earnings (EPS).

- We like VNT’s revenue and yield outlook, believing investors will focus on it more in the coming years. For example, Chicago-based Nuveen Quant International Small Cap Fund bought almost 2 million shares in November.

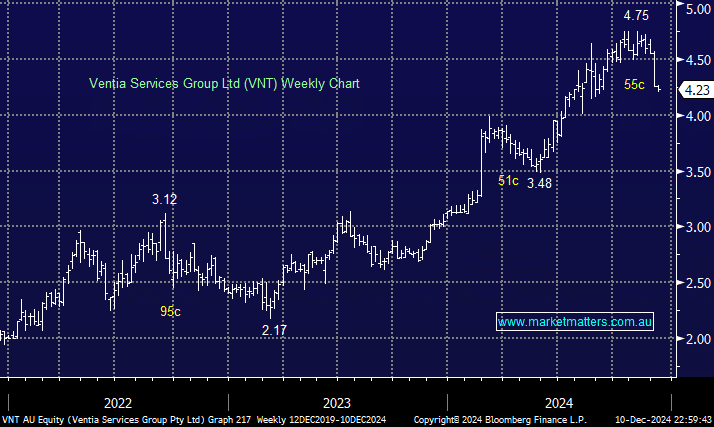

The risk/reward towards VNT has improved after the stock’s recent ~11% pullback, although it remains up 35% year-to-date.

- We can see VNT testing the $5 area in 2025 while paying 80% franked dividends in February and August – we have added VNT to our Hitlist.