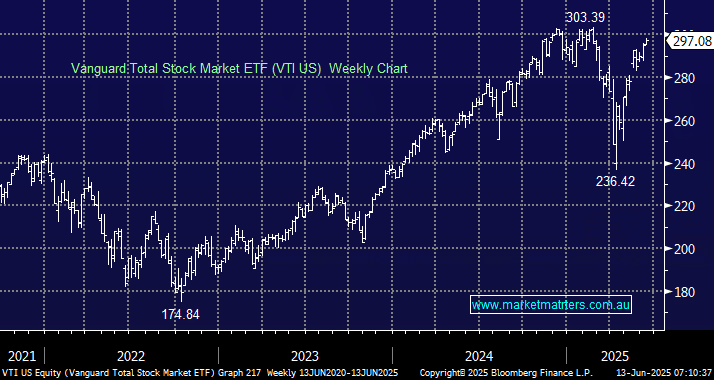

The VTI ETF is a $US1.6 trillion behemoth of an ETF that charges just 0.03% to provide investors with exposure to the rarely discussed CRSP US Total Market Index. The ETF currently holds 3,639 stocks, affording investors exposure to both the S&P 500 well-known names and a much smaller corner of the market representing the total US stock market. This ETF has tracked its benchmark, the broad-based US stock market, to within 0.01% over the last 1,3 and 5 years. Not surprisingly, when we combine its performance and extremely low fees, MM believes this is an excellent US-traded ETF for broad exposure to US stocks.

This ETF is also available on the ASX under the code of VTS, although its tracking hasn’t been as close because it’s not currency hedged, i.e. investors are holding $US-dollar-denominated stocks in an ETF priced in $A. Hence, when the $A appreciates against the $US, the performance of the VTS will lag that of the VTI, but to local investors who don’t hedge, it makes little difference if you want to hold US stocks.

- We like both the VTI and VTS ETFs for exposure to the broad-based US market.