The VSO ETF seeks to track the return of the MSCI Australian Shares Small Cap Index before costs. Of the 190 stocks held, the five largest positions are Technology One (TNE) 2.5%, JB Hi-Fi (JBH) 2.5%, GPT Group (GPT) 1.9%, Orica (ORI) 1.9%, and Mirvac (MGR) 1.9% with plenty of smaller positions in the mix, but not as “small cap” as many may initially think: The index/ETF aims to capture the small cap size segment of the Australian equity market which represents approximately 14% of its market capitalisation, i.e. no heavyweights. From a sector perspective, its main weightings are 17% in mining, 13% in REITs, 7% in retail and 5% in Software. If we are correct and the local small caps push to a new high through 2025, this ETF has ~12% upside.

- The VSO ETF has a relatively small 0.3% expense ratio and tracks its benchmark very well; for example, over the last 3 years, the VSO has advanced by 10.5% while the MSCI Australian Shares Small Cap Index has gained 10.7%.

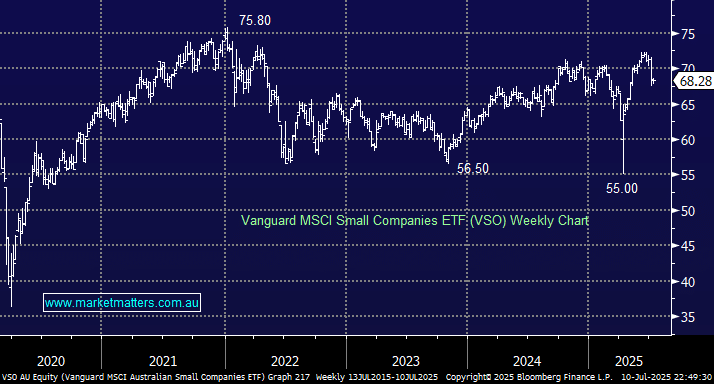

The VSO looks set to follow the MM roadmap into Christmas, testing the 76-78 area, but we highlight it as a high beta play; it comes with risks. If sentiment sours, the small caps are likely to underperform the ASX200.

- We are bullish on the VSO ETF and initially target a test/break of $76, or 12-14% higher.