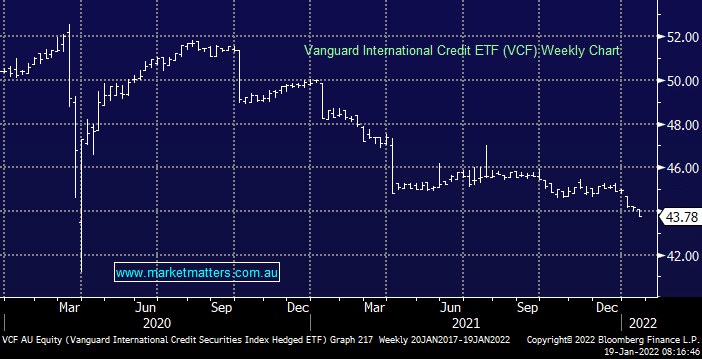

One of our major calls for 2022 is that bond yields will not follow through on the upside after they make fresh multi-year highs – less than 3-weeks into the year and we’ve already seen the break out in yields the question is now do we look to fade the move and if so how / when. Experience tells us that using ETF’s to track bond yields is not always a perfect science which can be frustrating at times but if we decide to “play” our view its likely to be via buying the ASX listed VCF into current weakness – on the ground level borrowing money to invest in bonds makes zero sense.

Hence Its important to recognise such a move would be a trade, as opposed to an investment and probably not for us but certainly worth monitoring as it will have a profound impact on a number of different markets, potentially simply buying a US tech focused ETF into its current sell off makes more sense!