The European ETF industry has experienced significant growth, with assets invested reaching a record of $US2.37 trillion at the end of January 2025. The VGK US-traded ETF provides investors with exposure to 16 European bourses ranging from the UK, Germany and France to Finland and neighbouring Norway. The fund currently holds 1,263 securities across various countries and industries, aiming to track the FTSE Developed Europe All Cap Index, which provides broad, diversified exposure to European stocks.

The ETF only charges 0.06% pa and has outperformed its benchmark over the last 1,3, and 5-years, helped by strength in the Euro as investors in this US ETF are holding European stocks, while the VGK is priced in $US. If the Euro or British Pound strengthen against the $US, as they did overnight, VGK’s NAV rises, potentially more than the local index, delivering outperformance.

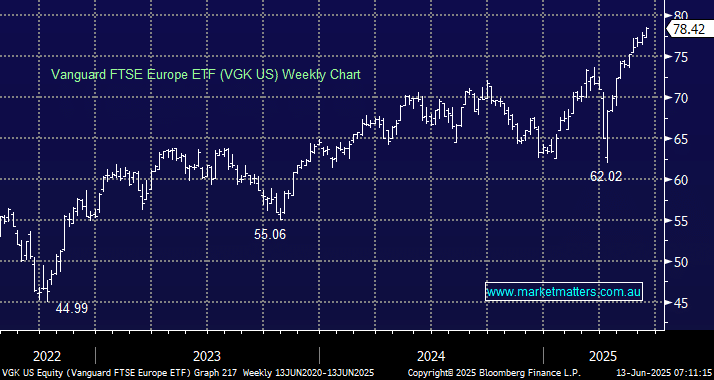

We are like this ETF, but the risk/reward is unappealing in the $US78 area.