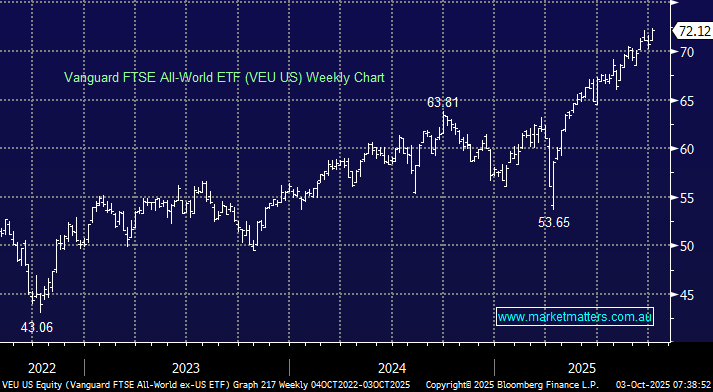

Appetite is strong for the VEU ETF, although as we said, it lags direct US equivalents. Global equities posted fresh highs this week, in line with their US peers, extending their impressive post-April rally. The huge $US50bn VEU ETF tracks the performance of the FTSE All-World ex-US Index, a job it’s performed admirably over the last 3-years, gaining +21.2% while the index has advanced +20.9%. The ETF holds a whopping 3856 positions at present, spread across Japan 15.4%, UK 8.6%, China 7.8%, Canada 6.7%, France 6.1% etc, an impressive offering for just 0.04%. Importantly, we like this ETF but believe one that also holds US stocks makes more sense, like the VGS.

- We like VEU ETF but believe it will underperform the ETFs, including AI-inspired US stocks, into 2026, such as the $5bn iShares Global 100 ETF (IOO), which is traded on the ASX.