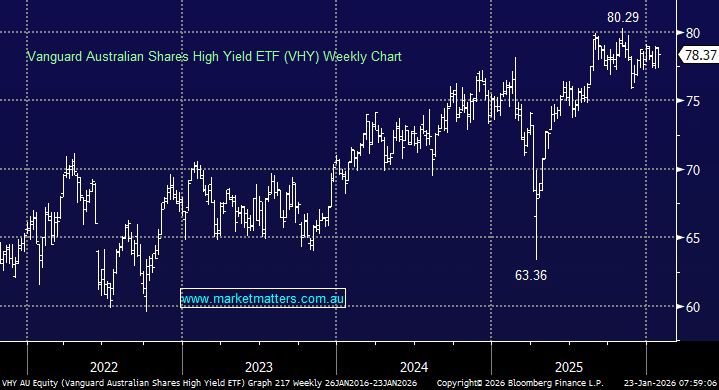

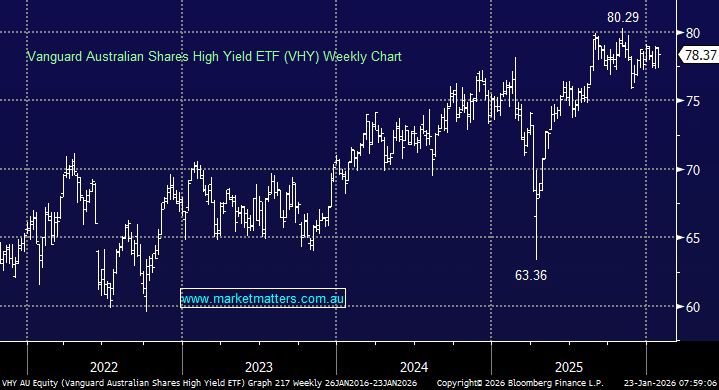

The ASX provides yield in abundance compared to its global peers, plus it has the added attraction of franking credits for many local investors. In a market where valuations in certain sectors are stretched, and leadership is unusually narrow, dividend-growth ETFs offer something different—companies with durable earnings, reliable cash flows, and long histories of rewarding shareholders. Importantly, dividend-growth strategies have also tended to outperform during late-cycle and volatile periods, the kind of environment that often emerges after major advances. We like the widely trusted and largest $6.3bn ASX-traded VHY ETF to invest for yield, which charges a reasonable 0.25% fee:

- The ETF holds 80 stocks, with its 5 largest positions currently BHP, CBA, Westpac, NAB, and Telstra – bank heavy, but the “Big Four” only make up ~29% of the ETF.

We expect ongoing market volatility as we head through 2026/7, making this ETF an ideal investment – it pays a dividend quarterly and is forecast to yield ~3.7% in the next 12-months.

- We like the VHY for yield and potential market outperformance in the coming year (s).