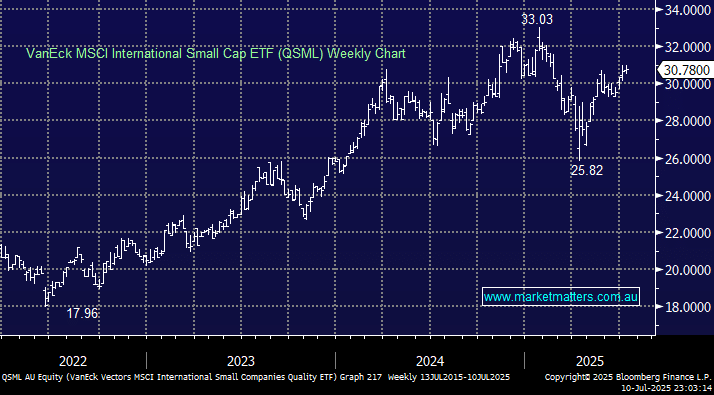

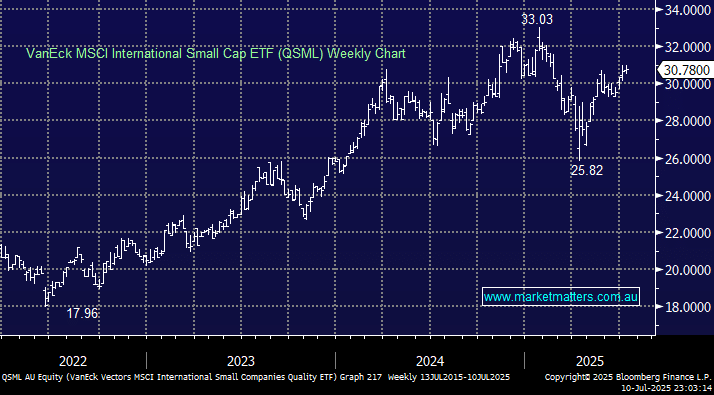

The QSML ETF aims to track the MSCI World ex-Australia Small Cap Quality 150 Index (unhedged). The Fund currently holds 159 stocks with a lot around the 1% weighting. From a geographical perspective, the QSML’s current exposure is led by 80% in the US, 6% in the UK, 4% in Japan, 3% in Switzerland, and 2% in Sweden, i.e. very US-focused. If we are correct and global small caps push to a new high through 2025, this ETF has 9-12% upside, demonstrating the underperformance of the US Russell 2000 (small-cap) index.

- The QSML incurs a 0.59% expense ratio and tracks its benchmark relatively well; for example, over the last three years, the QSML has advanced by 18.5%, while the MSCI World ex-Australia Small Cap Quality 150 Index has gained 19.3%.

The QSML ETF looks capable of following the MM roadmap into Christmas, testing the 34-36 area.

- We are bullish on the QSML ETF and initially target a test/break of $34-36 area, or 9-12% higher.