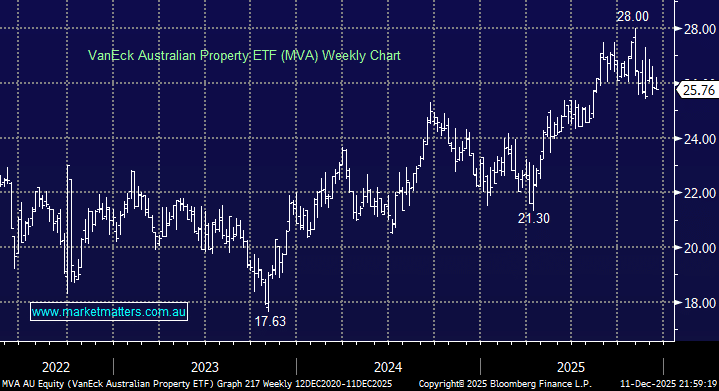

This MVA ETF gives comprehensive coverage to the ASX200 property sector, which, as would be expected, has struggled as credit markets changed their stance towards local interest rates into 2026. The reaction has been far tamer than with tech, which has also needed to deal with the ”AI Trade” being banished to the proverbial naughty corner. If hawkish fears fade with more soft data, like yesterday’s employment numbers, we should see a recovery by Australian property stocks, but this may take time.

We believe that Michele Bullock will refrain from hiking rates in 2026; hence, at some stage, this sector and the MVA should regain its mojo, but the million-dollar question is to know when – we will be watching this very closely.

- We can see the MVA ETF consolidating around $26, but if we’re wrong and rates do indeed get hiked in 2026, it will be hard for it to challenge its October highs.