The MVB ETF seeks to track the return of the MVIS Australia Banks Index before costs. Of the nine stocks held, the five largest positions are ANZ Group (ANZ) 20.1%, Westpac Bank (WBC) 19.9%, Commonwealth Bank (CBA) 19.8%, National Bank (NAB) 19.7%, and Macquarie Group (MQG) 17.6%, before 1-2% holdings in the regionals. There are no great surprises in its holdings except, perhaps, CBA not being the biggest. The ETF has tracked its benchmark pretty well over time, delivering a +20.8% return over the last 3-years compared to a +21.4% return by the Banks Index. The ETF is projected to yield around 4% part-franked over the 12-months, with dividends paid four times a year as the respective holdings pay shareholders.

- The MVB ETF has a relatively small 0.28% expense ratio, and tracks its benchmark pretty well over time, delivering a +20.8% return over the last 3-years compared to a +21.4% return by the Banks Index.

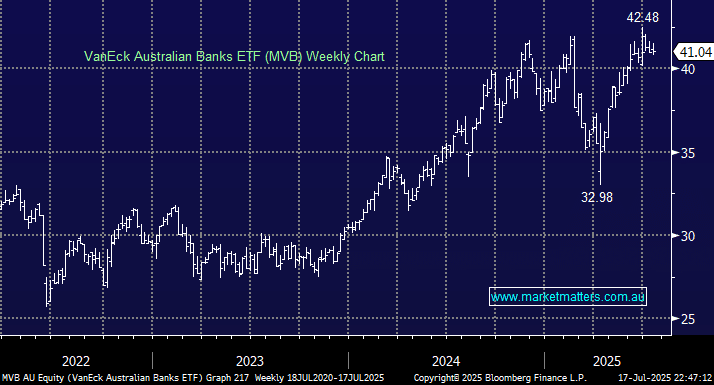

The MVB looks set to follow the MM roadmap into Christmas, posting new highs, but we feel that in this case, better returns and dividends are likely from pure plays in either ANZ Group (ANZ) or Westpac (WBC), in line with our view that CBA is likely to underperform into 2026.

- We are bullish on the MVB ETF, initially targeting a test/break of new highs, or 4-6% higher.