The VanEck Australia Australian Floating Rate ETF (FLOT) invests in floating-rate corporate and bank debt securities issued in Australia. Its interest payments adjust with market rates, providing potential protection against rising interest rates, while the fund maintains short-to-medium duration exposure to limit capital volatility. FLOT distributes income monthly, making it suitable for investors seeking regular income with lower interest-rate sensitivity compared to traditional fixed-rate bonds.

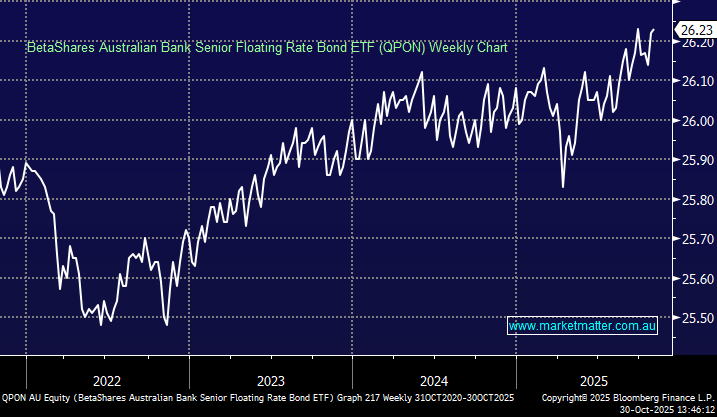

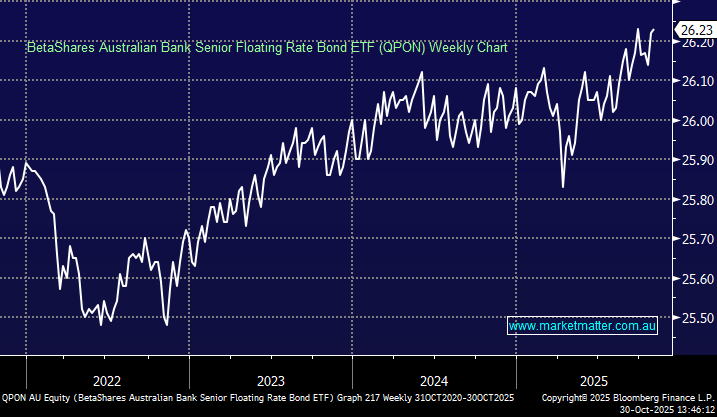

The specific objective of the fund is to provide investment returns that track the returns of the Bloomberg AusBond Credit Index. The management fee is low at 0.22% while it pays a monthly distribution equating to ~4.78% pa.. The ETF is reasonably well adopted and currently has a market cap of $890mn. The FLOT ETF carries slightly higher risk than the QPON due to corporate bond exposure and modestly longer durations, but still offers protection against rising rates.

- We like the FLOT ETF for investors seeking a slightly higher yield while being prepared to take on a bit more risk.