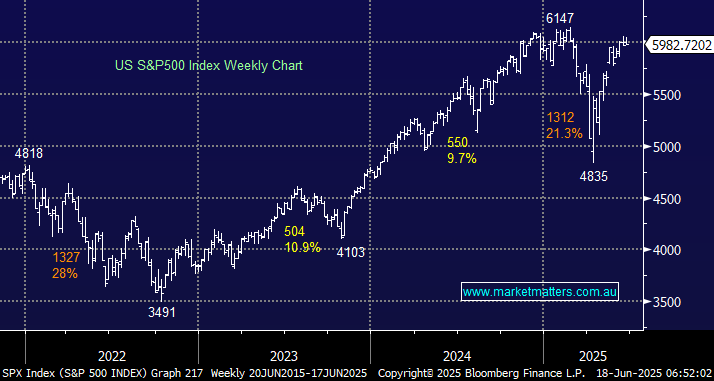

The S&P 500 slipped 0.8% overnight on fears of what comes next between Israel and Iran, and especially whether the US gets involved which may alienate the whole region. Risk-off sentiment prevailed overnight with WTI popping over 4%, and a gauge of crude-market volatility jumped to a three-year high. In a supporting role during the session, Treasuries rose as tepid reports on retail sales, housing, and industrial output supported bets that the Fed will cut rates at least once more in 2025 if energy prices don’t become a threat to the disinflationary path.

- We continue to believe it’s a matter of when, not if, the S&P 500 makes fresh all-time highs, although it feels unlikely until the Middle East conflict is resolved.