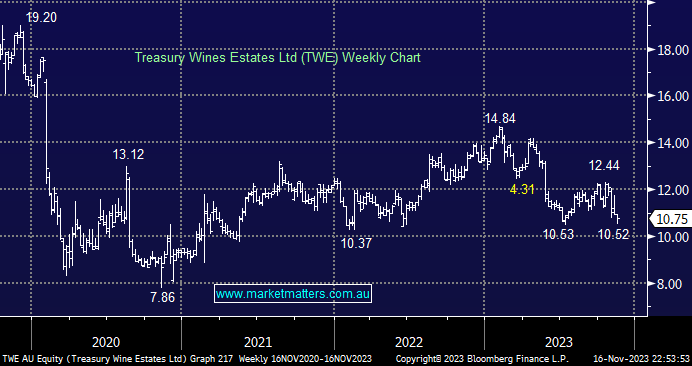

TWE has struggled over recent weeks even after Prime Minister Albanese’s apparent successful trip to China – it feels like too many traders were long looking for some easy short-term gains. However, the recent capital raise to fund its acquisition of Californian luxury wine brand DAOU Vineyards at $10.80 has proved to be the controlling factor for the share price short-term. We continue to like TWE, but patience will now be required as the company expands its footprint into the US.

- We believe TWE is compelling value around/under $11, but we’re conscious of not fighting the tape – MM is long TWE in our Active Growth Portfolio.