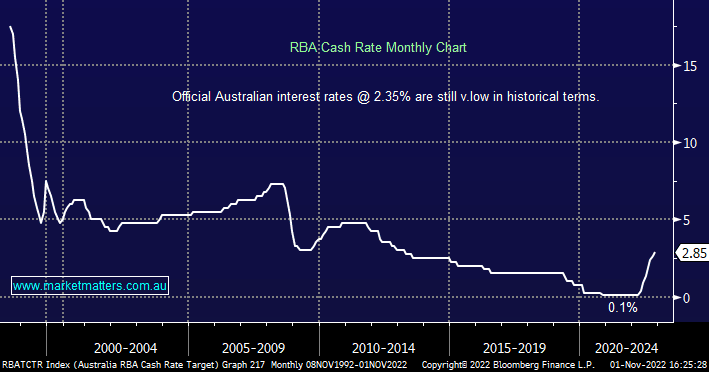

As most economists and MM forecast, the RBA increased the cash rate by 0.25% to 2.85% today, and have now raised interest rates by 2.75% over 7 months. It seems clear that the RBA are nearing a point of reflection (not inflexion!), with a final hike in December likely before they step back and see how the lag effect on this aggressive path of monetary tightening plays out. Key points from todays decision include:

- The RBA raised the cash rate target to 2.85%, in line with our expectation and the consensus forecast.

- The RBA continued to signal further tightening, with a focus still on labor costs and firms’ price-setting behavior over the period ahead.

- They lifted their near-term inflation outlook, now seeing inflation peak around 8% in 2022 (versus 7.75% previously).

- However, they did leave their medium-term projection alone and this is a key input into their decision-making — forecasting inflation will return to “a little above 3% over 2024”.

- The RBA trimmed its growth outlook, now expecting the economy to grow 3% in 2022 (versus 3.75% in August), followed by expansions of 1.5% in 2023 and 2024 (1.75% in August).

- The weaker growth and a flat-lining labor market prompted the RBA to bring forward its forecast for a lift in the unemployment rate to 4.0% in 2024 (previously end of 2024) – up from 3.5% currently.

- Current pricing in markets still seems too aggressive, with a cash rate of 3.9% priced in by 2H23.