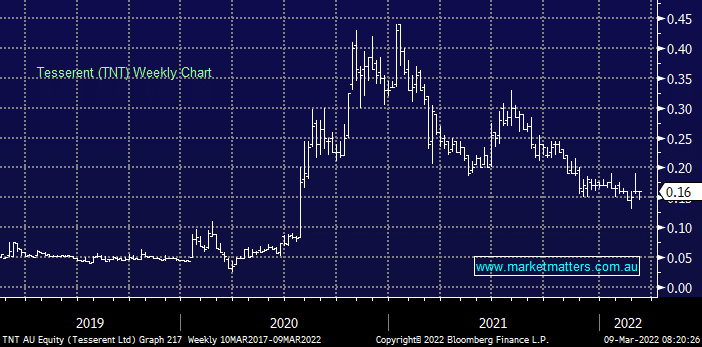

Tesserent is a ~$200m cyber security business that works with both government and private enterprise, that should in theory be killing it in this current environment. We actually answered a question on it recently which prompted todays spiel. We spoke to the company soon after they released their solid 1H results and I was impressed with how management presented. They have a number of Government contracts that provide a solid, long term base to revenue and management noted the ability to pass on price increases across these deals. Their commercial business has seen margins rise, but employment costs are also on the move given the specific skills Tesserent need. They are cashflow positive and will be targeting new acquisitions which should help them grow earnings over time. We like the exposure to an ‘in demand’ space and this is one we will keep on our Hit List for now, we would prefer to wait and see them execute on their growth strategies before gaining greater conviction in the story.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM has TNT on our Hit List

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.