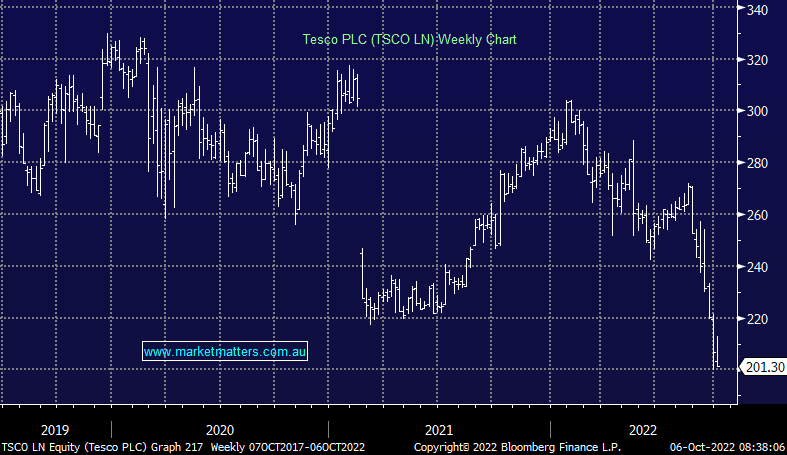

The UK-based supermarket fell 4% overnight following their 1H result which was strong in terms of sales growth while slightly weaker in terms of margins as they go head to head with Aldi & Lidl for market share. Tesco now expects full-year retail adjusted EBIT of £2.4b to £2.5b, compared with a previously-guided range of £2.4b to £2.6b, not a big reduction and the 1H results do show resilience, but tough conditions mean the outlook is more cautiously nuanced in the 2H. Overall, we had Tesco earmarked as a funding vehicle for other purchases and the overnight result does nothing to change that view.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is likely to sell TSCO LN in the International Equities Portfolio

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.