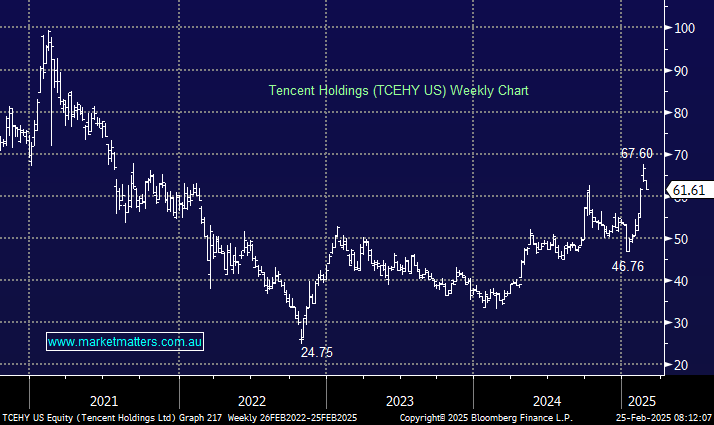

On Monday, TCEHY tumbled over 7% as Trump weighed on China-facing stocks. Tencent leverages AI in gaming, cloud computing, and social media platforms (WeChat). It also has its own AI lab and invests in AI-driven healthcare and fintech, i.e., it has many fingers in many pies. The company is performing solidly after it posted a better-than-expected 47% profit surge in Q3 of 2024, as games and AI tools led the way, although an 8% revenue increase was slightly below expectations. We like the moving parts of Tencent moving into a new AI world and can see the stock addressing its underperformance over recent years as it starts to reap the benefits of investment in AI.

- “We are increasingly seeing tangible benefits of deploying AI across our products and operations, including marketing services and cloud, and will continue investing in AI technology, tools and solutions that assist users and partners,” Tencent said in last year’s earnings release.

- We can see Tencent attracting buyers around $US60, but we hold Abibaba & JD.com for China exposure.