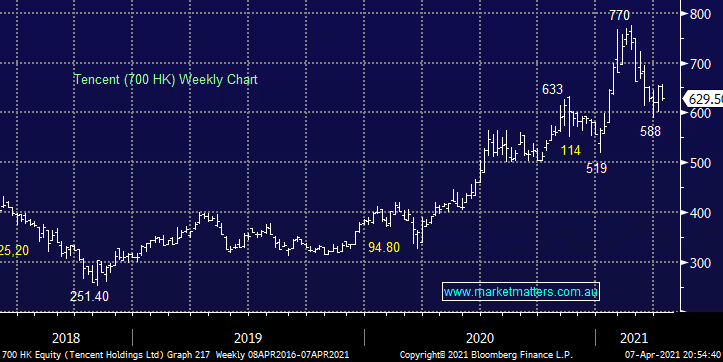

Yesterday, the largest shareholder of Asia’s largest technology company Tencent was looking to sell 2% of the company reducing it’s stake from 30.9% down to 28.9% raising around US$14 billion in the process. While this is a short term negative for the share price, the seller Prosus has committed not to sell any further shares for at least 3 years. This is actually a remarkable story given Prosus, which invests in internet based technology companies, invested just $US32m in Tencent back in 2001 and the shares today are worth a staggering US$239 billion.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM remains bullish Tencent

Add To Hit List

Related Q&A

Southern Cross Elec. Eng. (SXE) & IPD Group (IPG)

Light & Wonder (LNW), Southern Cross Electrical (SXE) and A1M (AIC Mines)

Nine Entertainment (NEC) and Southern Cross Electrical (SXE)

Southern Cross Elec. Eng. (SXE) and Catapult (CAT):

Data Centres – MAQ and SXE

Thought on IPG and TLX

Thoughts on NXT and SXE please

Thoughts on Southern Cross Electrical Engineering (SXE)

Comment on SXE

Investing in video gaming

Updated thoughts on Alibaba (BABA US)

China Tech – do we intend to cut & run?

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.