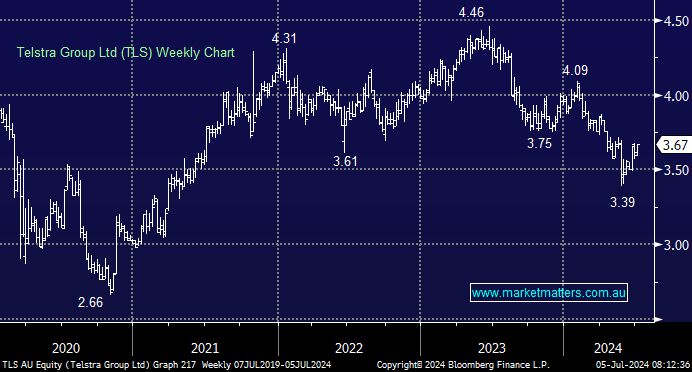

TLS would be many Australian investors’ initial thought when picking defensive stocks, although it hasn’t delivered a healthy performance over the last year. However, as discussed in May following the company’s update, we believe TLS is a stock for income instead of growth; hence, it is unlikely to find its way onto our Active growth Hitlist.

- We like TLS for income as opposed to growth and see value at current levels – MM is already long TLS in our Active Income Portfolio.