TNE delivered a strong 1st half result in May, the HR & asset management SaaS company saw annual recurring revenue (ARR) rise 44% on last year to $225mn while its Profit Before Tax (PBT) was up 14% to $42.5mn. The company reiterated long-term guidance of $500m ARR by FY26, and provided FY22 guidance that looks conservative given the first-half performance. They flagged profit growth of 10-15% and ARR growth of 40% for the full year, a 6% improvement on prior guidance. Overall we believe these were a strong set of numbers that should provide a decent tailwind for TNE whenever the Tech Sector is in favour.

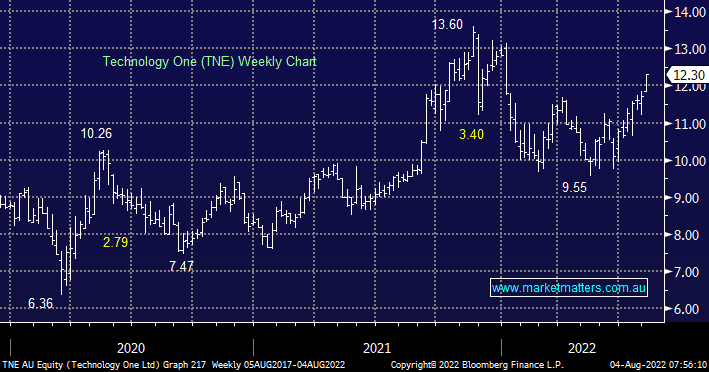

- We believe that TNE in a similar fashion to WTC will see fresh highs in the coming 12 months.