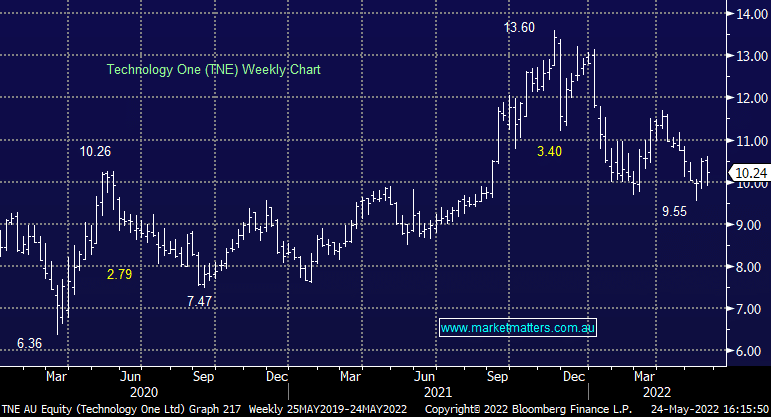

TNE -1.63%: first-half results were out for the HR & asset management SaaS business today with shares tracking lower despite a positive presentation. Annual Recurring Revenue (ARR) was up 44% on last year to $225m and Profit Before Tax (PBT) was 14% higher to $42.5m, both a small beat to expectations. Cashflow was weak, attributed to further R&D expenditure, though that is expected to normalize. The company reiterated long term guidance of $500m ARR by FY26, and provided FY22 guidance that looks conservative given the first-half performance. They expect PBT growth of 10-15% and ARR growth of 40% for the full year, a 6% improvement on prior guidance. Overall a strong set of numbers though shares were lower with the tech sector under pressure.

scroll

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is marginally bullish TNE but prefers XRO in the space

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.