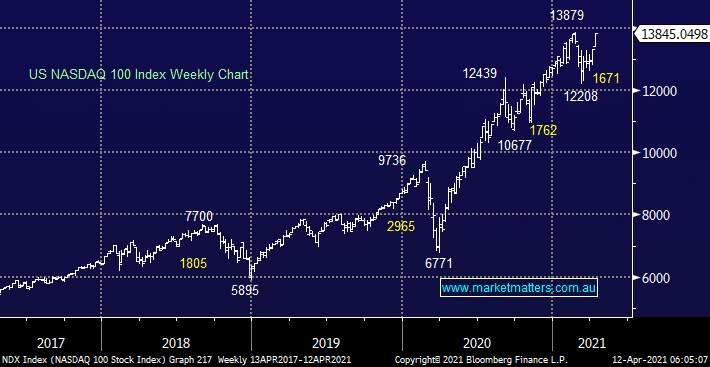

As mentioned above, the tech based NASDAQ had a great week and is now one good session away from breaking out to all-time highs. Consolidation in bond yields during the week was the key which confirms in MM’s mind that it’s the pace at which interest rates had risen rather than the absolute level of rates that the market really cares about. Whether interest rates are at 1.7% or 2.5% the market will deal with it, and in MM’s view conclude that it’s a low absolute level, however when rates rise ~300% in ~6 months it creates an obvious headwind, particularly for long duration assets like high value growth stocks.

scroll

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

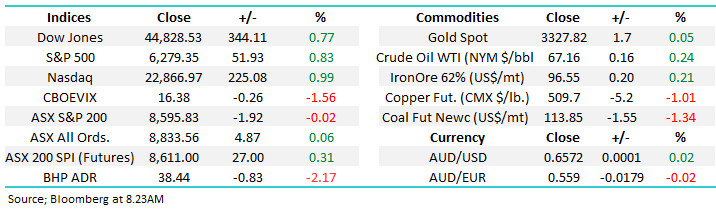

Friday 4th July – Dow up +344pts, SPI up +27pts

Friday 4th July – Dow up +344pts, SPI up +27pts

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Global X Battery Tech and Lithium ETF (ACDC)

Global X Battery Tech and Lithium ETF (ACDC)

Close

Close

MM has now become more neutral the NASDAQ around all time highs

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 4th July – Dow up +344pts, SPI up +27pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

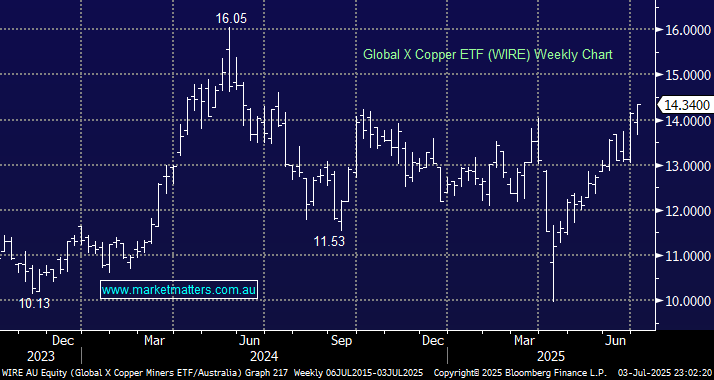

chart

Global X Battery Tech and Lithium ETF (ACDC)

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.