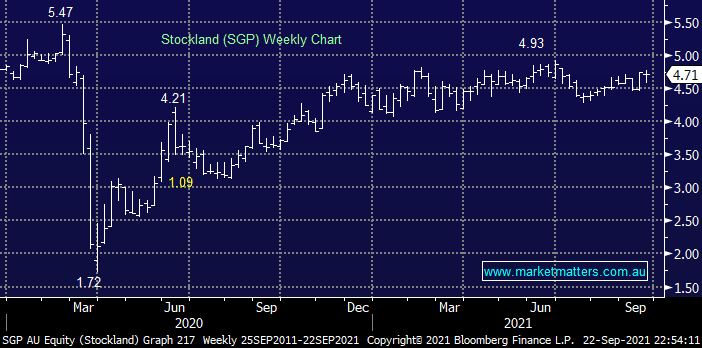

This REIT has tracked the Australian Real Estate Sector almost perfectly, it feels tired around $5 while buyers clearly emerge into weakness back around $4 and $4.50, this makes sense for a stock forecast to yield 5.22% over the next 12-months. SGP benefited, as did MGR, from strong residential sales but their also making strong headway from their retirement living operations with settlements up over 22% in FY21.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral / slightly positive SGP

Add To Hit List

Related Q&A

ASX Real Estate Stocks

Opinion and/or analysis LYC, APA, SGP

Thoughts on some property stocks please

Ask James- REITS

How to play bond yields & real-estate stocks?

What stocks for property exposure?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.