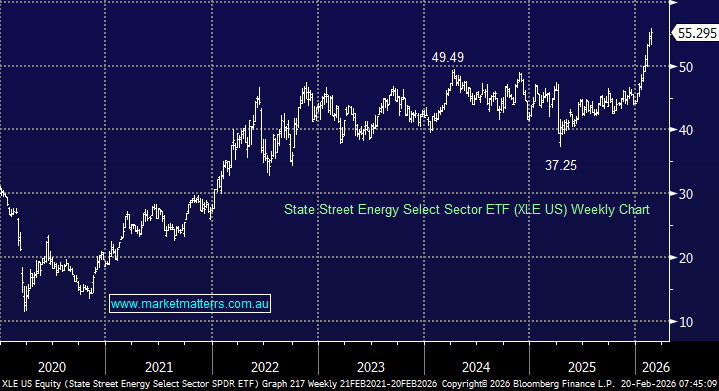

This US-traded ETF provides investors with concentrated exposure to large-cap U.S. oil and gas companies by tracking the energy constituents of the S&P 500 Index. It’s the Big Bertha of energy ETFs, holding more than $US37bn in assets. Not surprisingly, it has a very similar look and makeup to the FUEL ETF, with the main difference being around hedging, i.e. importantly as a local investor, you are holding $US denominated assets.

- The ETF currently holds 45 stocks, with its 5 largest positions currently Exxon, Chevron, Shell, ConocoPhillips, SLB Ltd, and Williams Cos – but we note its very concentrated at the top end with Exxon & Chevron carrying a more than 40% weight.

Like all companies in the energy space, we believe this ETF has a real tailwind over the coming years as global energy demand is widely expected to continue increasing through the 2020s, with most models pointing to material growth, likely on the order of 15-20% gains by 2030 relative to today’s levels, though exact figures depend on policy scenarios and assumptions about efficiency and technology advancements.

- We are looking for the XLE ETF to consolidate recent gains over the coming weeks/months.