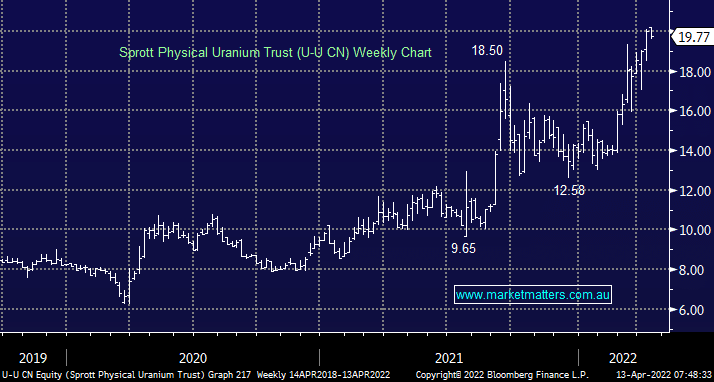

Uranium prices have been rallying with spot trading ~$US63.50, the highest level since before the devasting events in Fukushima in March 2011. As countries around the world look to address their carbon footprint, nuclear energy is gaining traction as a viable part of the equation. The Sprott Physical Uranium Trust held in the MM Macro ETF Portfolio has also been a dominant factor in the equation. This vehicle buys and holds physical Uranium on behalf of investors in the Trust and now has a net asset value (NAV) of an astonishing ~$US3.5bn. While there are some conditions around when buying takes place, essentially when new units in the trust are purchased, the trust goes into the market and buys the equivalent amount of Uranium. This year alone the trust has attracted ~$US750m in new capital and has been a contributing factor for spot Uranium prices to move from the mid $US30/lb to now trade in the US$60’s which is a price point high enough to incentivise the restart of some Uranium mines, such as the one owned by Paladin.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

BetaShares Australian High Interest Cash ETF (AAA)

BetaShares Australian High Interest Cash ETF (AAA)

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

BetaShares Australian Bank Senior Floating Rate Bond ETF (QPON)

BetaShares Australian Bank Senior Floating Rate Bond ETF (QPON)

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

MM remains bullish & long Uranium

Add To Hit List

Related Q&A

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

chart

BetaShares Australian High Interest Cash ETF (AAA)

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

chart

BetaShares Australian Bank Senior Floating Rate Bond ETF (QPON)

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.