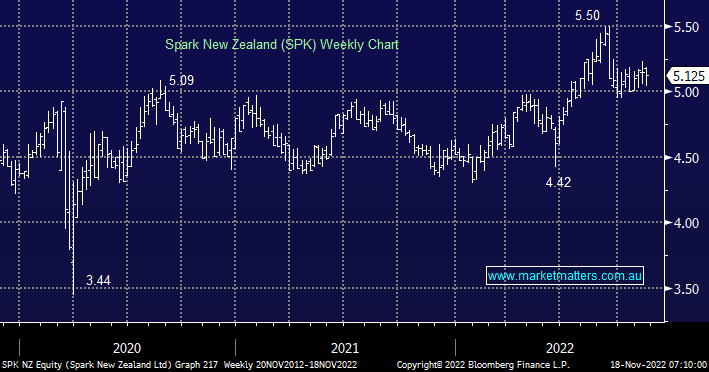

SPK, formerly Telecom Corp. of NZ, has performed strongly through 2022 advancing +8.8% in a tough environment but it’s not particularly cheap above $5 forcing us into a neutral corner. We like SPK on its improving outlook for mobile revenue and prospect of higher dividend growth – a few months ago they reported a strong FY22 EBITDA of $1.150bn which was in line with guidance.

- We like this telco with its estimate of a 4.8% yield over the next 12 months but it will need dips under $5 to scan well on all metrics for us.