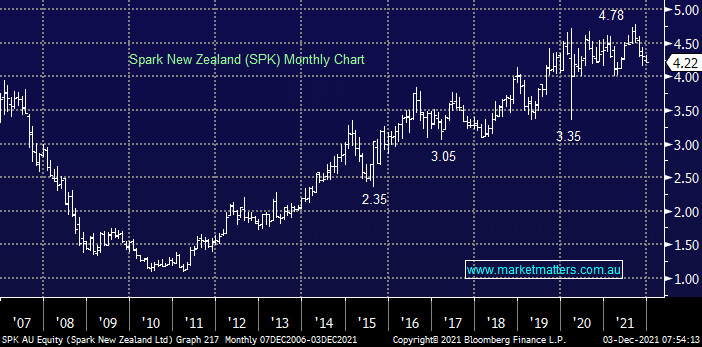

SPX has been the standout sector performer over recent years but it feels fully priced near the $4.50 area. The company has significant infrastructure spend planned for 2022 including funds to accelerate the 5G rollout. We really like what the business has achieved over recent years but it’s a touch harder to see major growth moving forward e.g. the companies already on track to cover 90% of New Zealanders by 2023. However an estimated 5.6% yield over the next 12-months makes the stock very attractive for the income hungry moving forward, especially into any dips.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM likes SPK into pullbacks

Add To Hit List

Related Q&A

Your thoughts on Inghams (ING) and Spark New Zealand (SPK)

(APA) Group SPARK (SPK) and Aurizon (AZJ)

(SPK) Spark

Your thoughts on 2 related stocks

Spark New Zealand (SPK)

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.