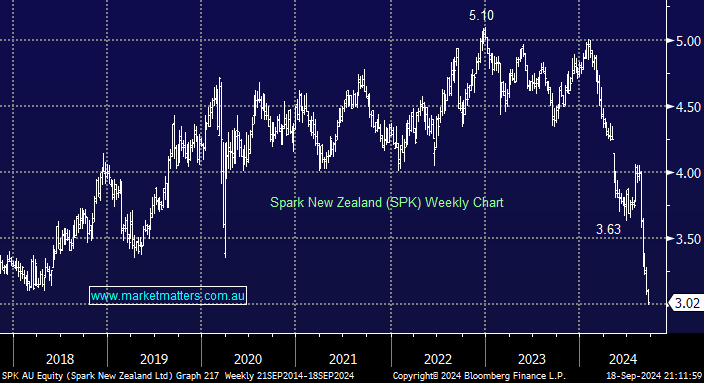

SPK has tumbled 40% from its 2024 high following a 4% downgrade in May and an FY24 miss in August. Last month, revenue missed analyst estimates by 1.7%, and Earnings per share (EPS) also missed analyst estimates by 24%. Our first thought is that downgrades/misses often happen in threes, so there’s no hurry to catch this falling knife just yet. Interestingly, the NZ FY24 reporting season was one of two halves.

- Over the 1st, the BNZ transitioned the NZ economy into an interest rate-cutting cycle, resulting in a sentiment shift in consumer and business confidence, driving the NZ equity market up +3%.

- The 2nd half saw lacklustre earnings and weak company guidance across most sectors, including tougher trading conditions in the high-yielding telco sector in 2024.

SPK has been a classic “yield trap” in 2024, but we believe it will be worth watching if we get another leg lower.

- We have no plans to buy a stock which such weak momentum, but it will start to present value under $3—its yield is already estimated to be over 8%.