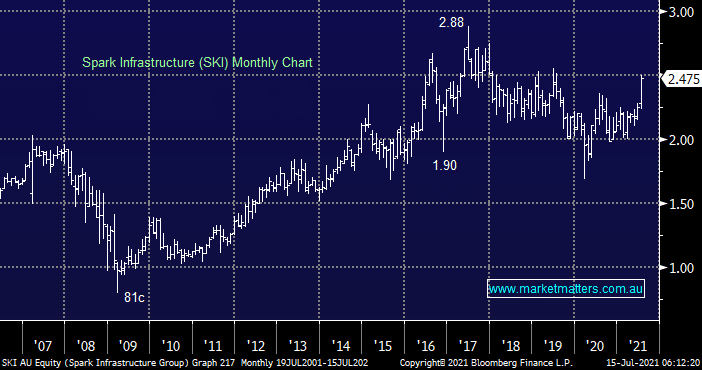

SKI charged out of the blocks yesterday finally closing up +7.8%, best on ground for the day and at it highest level since mid-2019 proving that action can even unfold in the often regarded most boring end of town. The Australian was touting another takeover was looming and the price action certainly endorsed these rumours, the numbers certainly look ok for such a move:

- The stock trades at a slight valuation discount to the sector average.

- The infrastructure company holds a number of quality assets such as a 49% holding in VIC & SA Power Networks, 15% of TransGrid (NSW) and the Bomen Solar Farm.

- The stocks estimated to yield ~6% over the next 12-months.

It will be fascinating to see how this unfolds over the next 24-48 hours but the main takeout for us is the appetite for M&A remains very strong.