SXE took a meaningful hit last week, albeit only brief – after cutting its FY26 EBITDA guidance by $44m, following an unfavourable arbitration ruling tied to legacy works on the WestConnex M5 motorway tunnel through its Heyday subsidiary. The downgrade is material, but importantly, the costs are one-off, historical and do not alter the company’s underlying outlook.

SXE now expects FY26 EBITDA of $21–24m, down from prior expectations of $65–68m. Roughly $19m of the impact is non-cash through the write-off of a contract asset, while repayment obligations and expected interest/costs (~$25m combined) will affect both profit and cash, hitting the 1H26 accounts. The timing of cash outflows remains uncertain but is likely in the second half of FY26.

From our perspective, this is clearly a disappointing development, but it does not change the fact that SXE is a well-run operator leveraged to powerful structural trends: data centre build-out, electrification, infrastructure investment, and energy transition. These drivers remain intact, and our longer-term FY27–FY28 earnings expectations remained unchanged.

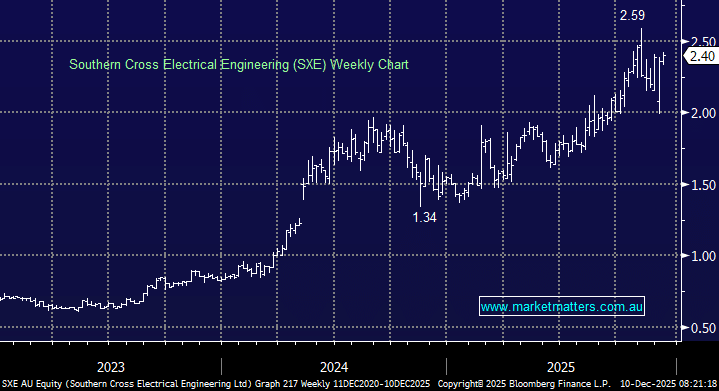

We do not currently hold SXE and were too slow to buy into the weakness that prevailed on the news. The snapback has been swift – a short, sharp 20% sell off before it’s back trading above levels prior to the announcement. We agree with the market’s ultimate reaction; the news does not alter the future growth of the business. Structural tailwinds and clean medium-term earnings visibility keep SXE firmly on our radar, we’re simply waiting for a more attractive level to step in.