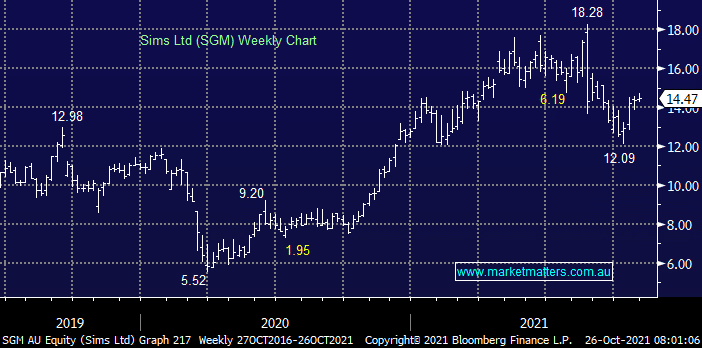

Metal recycling business SGM has corrected 34% pretty much in line with the iron ore sector although there are more strings to this recycling business. The company delivered earnings ahead of guidance for FY21 but after an initial spike higher the stocks struggled of late as lower scrap prices obviously impede profitability – a projected 3.75% yield also helps while we note UBS upgraded their earnings expectations for SGM yesterday and see the stocks trading north of $17.

scroll

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM likes SGM around $14

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.