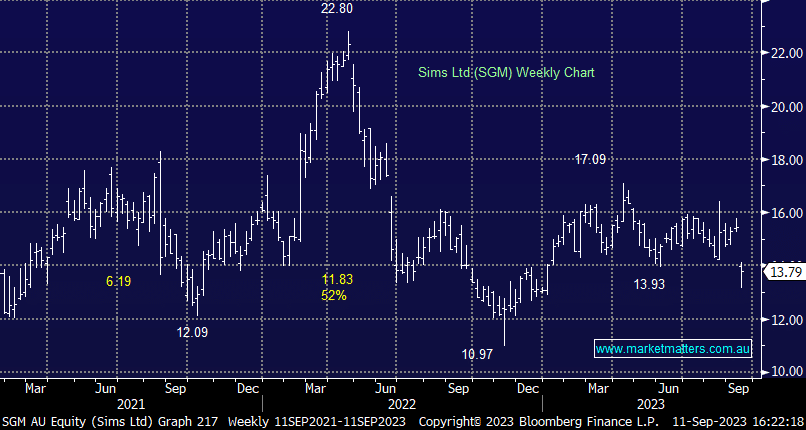

SGM -10.63%: Shares in the scrap metal trading company fell to 8-month lows today after the company warned the market of softer earnings early in FY24. They expect EBIT in the first quarter to be around breakeven while a bounce back is unlikely in the second quarter given weakening volumes in the North American market, an area which remained resilient until now. Prices in scrap metal have been hit by soft demand, which has also been a drag on supply in the market which is hitting both sides of the company’s earnings. Sims remains confident in its ability to generate profits over the longer term, however, there seem to be fundamental issues with the scrap market in the short term which we expect will lead to ~10% downgrades to expectations for FY24.

scroll

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Thursday 3rd July – Dow -10pts, SPI off -11pts

Thursday 3rd July – Dow -10pts, SPI off -11pts

Close

Close

MM has no interest in SGM ~$14

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – Dow -10pts, SPI off -11pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.